| Zacks Company Profile for Bodycote (BYPLF : OTC) |

|

|

| |

| • Company Description |

| Bodycote PLC provides thermal processing services through heat treatment, metal joining, surface technology and Hot Isostatic Pressing. It serves aerospace, defense, automotive, power generation, oil & gas, construction, medical and transportation industry. Bodycote PLC is headquartered in Macclesfield, the United Kingdom.

Number of Employees: 4,379 |

|

|

| |

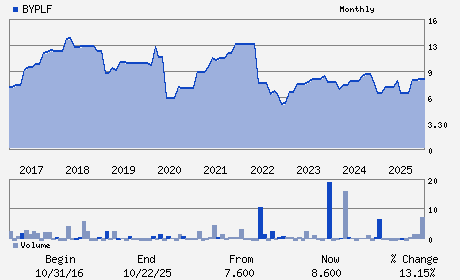

| • Price / Volume Information |

| Yesterday's Closing Price: $10.05 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 53 shares |

| Shares Outstanding: 177.48 (millions) |

| Market Capitalization: $1,783.66 (millions) |

| Beta: 0.45 |

| 52 Week High: $10.05 |

| 52 Week Low: $6.84 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.00% |

0.87% |

| 12 Week |

16.86% |

16.72% |

| Year To Date |

16.86% |

16.29% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Stephen Harris - Chief Executive Officer

Daniel Dayan - Chairman

Ben Fidler - Chief Financial Officer

Patrick Larmon - Director

Lili Chahbazi - Director

|

|

Peer Information

Bodycote (GENC)

Bodycote (BYPLF)

Bodycote (GBTG.)

Bodycote (ZBRA)

- (-)

- (-)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH-THRML PROC

Sector: Industrial Products

CUSIP: G1214R111

SIC: 3559

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: 03/13/26

|

|

Share - Related Items

Shares Outstanding: 177.48

Most Recent Split Date: (:1)

Beta: 0.45

Market Capitalization: $1,783.66 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/13/26 |

|

|

|

| |