| Zacks Company Profile for CACI International, Inc. (CACI : NYSE) |

|

|

| |

| • Company Description |

| CACI International Inc. provides the IT and network solutions needed to prevail in today's new era of defense, intelligence and e-government. CACI customizes, implements and maintains commercial-off-the-shelf and custom ERP systems, including financial, human capital, and supply chain management systems. CACI designs, develops, integrates, deploys & sustains enterprise-wide IT systems in a variety of models. As an Amazon Web Services Premier Consulting Partner & Microsoft Gold Cloud Solution Provider for Government, it delivers cloud-powered solutions, performance-based service management, software-as-a-service secure mobility, defensive cyber & network security, end-user services and infrastructure services. The company provides capabilities that enable the execution of a government agency?s primary function or mission. CACI develops tools and offerings in an open, software-defined architecture with multi-domain and multi-mission capabilities and delivers technology to both enterprise and mission customers.

Number of Employees: 25,000 |

|

|

| |

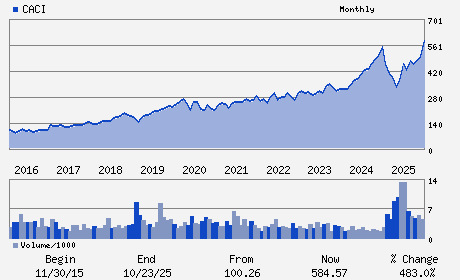

| • Price / Volume Information |

| Yesterday's Closing Price: $610.17 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 257,988 shares |

| Shares Outstanding: 22.09 (millions) |

| Market Capitalization: $13,476.08 (millions) |

| Beta: 0.60 |

| 52 Week High: $683.50 |

| 52 Week Low: $327.30 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-1.68% |

-0.82% |

| 12 Week |

2.44% |

2.31% |

| Year To Date |

14.52% |

13.96% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

12021 SUNSET HILLS ROAD TWO RESTON OVERLOOK

-

RESTON,VA 20190

USA |

ph: 703-841-7800

fax: 703-841-7882 |

ir@caci.com |

http://www.caci.com |

|

|

| |

| • General Corporate Information |

Officers

John S. Mengucci - Chief Executive Officer

Lisa S. Disbrow - Chair of the Board

Jeffrey D. MacLauchlan - Chief Financial Officer

Eric F. Blazer - Senior Vice President

Susan M. Gordon - Director

|

|

Peer Information

CACI International, Inc. (CE.1)

CACI International, Inc. (UMLS)

CACI International, Inc. (DGLHQ)

CACI International, Inc. (ANLY)

CACI International, Inc. (EPRE.)

CACI International, Inc. (CBIS.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: COMP-SERVICES

Sector: Computer and Technology

CUSIP: 127190304

SIC: 7373

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/22/26

|

|

Share - Related Items

Shares Outstanding: 22.09

Most Recent Split Date: 12.00 (2.00:1)

Beta: 0.60

Market Capitalization: $13,476.08 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $7.09 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $28.63 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 10.57% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/22/26 |

|

|

|

| |