| Zacks Company Profile for Avis Budget Group, Inc. (CAR : NSDQ) |

|

|

| |

| • Company Description |

| Avis Budget Group operates as a leading vehicle rental operator and a leading global provider of mobility solutions through its three most recognized brands: Avis, Budget and Zipcar. It maintains a leading share of airport car rental revenue in N. America, Europe & Australasia and operates one of the leading truck rental businesses in the U.S. It mainly generates revenues from vehicle rental operations that include time & mileage fees charged to customers for vehicle rentals, sales of loss damage waivers and insurance and other supplemental items in conjunction with vehicle rentals, and payments from customers with respect to certain operating expenses incurred. It earns revenues for royalties and associated fees from its licensees in conjunction with their vehicle rental transactions. It has two segments: Americas, operating in the U.S. and International, operating globally. These segments provide vehicle rental operations, car sharing operations, and licensees.

Number of Employees: 25,000 |

|

|

| |

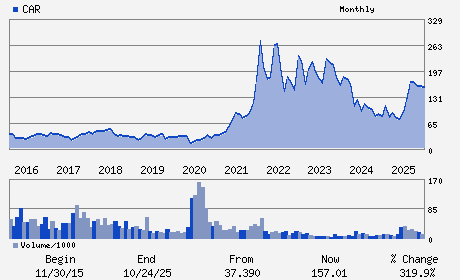

| • Price / Volume Information |

| Yesterday's Closing Price: $97.41 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 906,029 shares |

| Shares Outstanding: 35.26 (millions) |

| Market Capitalization: $3,434.54 (millions) |

| Beta: 2.32 |

| 52 Week High: $212.81 |

| 52 Week Low: $54.03 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-15.29% |

-14.55% |

| 12 Week |

-27.76% |

-27.85% |

| Year To Date |

-24.09% |

-24.46% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

BRIAN J. CHOI - Chief Executive Officer

JAGDEEP PAHWA - Chairman of the Board

DANIEL CRESTIAN CUNHA - Executive Vice President

ANU HARIHARAN - Director

BERNARDO HEES - Director

|

|

Peer Information

Avis Budget Group, Inc. (HKAEY)

Avis Budget Group, Inc. (UHAL)

Avis Budget Group, Inc. (LYNG)

Avis Budget Group, Inc. (MATX)

Avis Budget Group, Inc. (GLC)

Avis Budget Group, Inc. (FAVS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TRANS-SERVICES

Sector: Transportation

CUSIP: 053774105

SIC: 7510

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 35.26

Most Recent Split Date: 9.00 (0.10:1)

Beta: 2.32

Market Capitalization: $3,434.54 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-4.99 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $6.19 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |