| Zacks Company Profile for The Chemours Company (CC : NYSE) |

|

|

| |

| • Company Description |

| The Chemours Company offers its customers with solutions across a vast spectrum of industries including plastics and coatings, refrigeration and air conditioning, mining and general industrial manufacturing and electronics. The company's major products include titanium dioxide (TiO2), refrigerants, industrial fluoropolymer resins and sodium cyanide. The company has manufacturing sites catering to customers across North America, Latin America, Asia-Pacific and Europe. It currently has four reportable segments: Titanium Technologies, Thermal & Specialized Solutions (formerly known as Fluoroproducts), Advanced Performance Materials (formerly known as Fluoropolymers) and Chemical Solutions.

Number of Employees: 5,700 |

|

|

| |

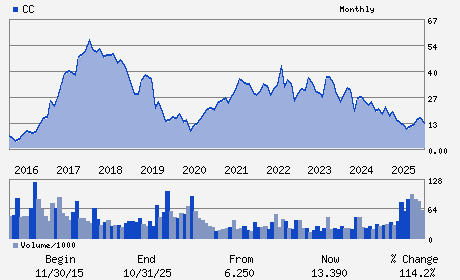

| • Price / Volume Information |

| Yesterday's Closing Price: $18.24 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 4,008,077 shares |

| Shares Outstanding: 150.09 (millions) |

| Market Capitalization: $2,737.56 (millions) |

| Beta: 1.60 |

| 52 Week High: $21.85 |

| 52 Week Low: $9.13 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

21.68% |

22.75% |

| 12 Week |

43.62% |

43.44% |

| Year To Date |

54.71% |

53.96% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Denise Dignam - Chief Executive Officer and President

Mary B. Cranston - Chairman

Shane Hostetter - Chief Financial Officer and Senior Vice President

David Will - Vice President and Controller

George R. Brokaw - Director

|

|

Peer Information

The Chemours Company (ENFY)

The Chemours Company (EMLIF)

The Chemours Company (GPLB)

The Chemours Company (BCPUQ)

The Chemours Company (CYT.)

The Chemours Company (SOA)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-DIVERSIFD

Sector: Basic Materials

CUSIP: 163851108

SIC: 2800

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 150.09

Most Recent Split Date: (:1)

Beta: 1.60

Market Capitalization: $2,737.56 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.92% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.00 |

Indicated Annual Dividend: $0.35 |

| Current Fiscal Year EPS Consensus Estimate: $1.45 |

Payout Ratio: 0.36 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: -0.03 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/27/2026 - $0.09 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |