| Zacks Company Profile for Crown Castle Inc. (CCI : NYSE) |

|

|

| |

| • Company Description |

| Crown Castle owns, operates and leases shared communications infrastructure that is geographically dispersed throughout the U.S., including towers and other structures, such as rooftops, and miles of fiber primarily supporting small cell networks and fiber solutions. Their operating segments consist of (1) Towers and (2) Fiber, which includes both small cells and fiber solutions. Their core business is providing access, including space or capacity, to our shared communications infrastructure via long-term contracts in various forms, including lease, license, sublease and service agreements.

Number of Employees: 4,000 |

|

|

| |

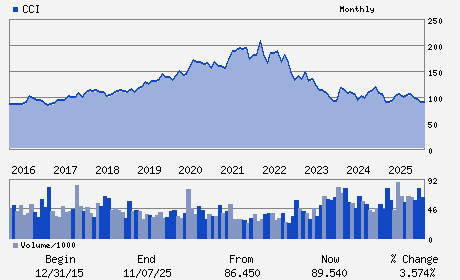

| • Price / Volume Information |

| Yesterday's Closing Price: $89.54 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 4,166,357 shares |

| Shares Outstanding: 436.07 (millions) |

| Market Capitalization: $39,045.75 (millions) |

| Beta: 0.96 |

| 52 Week High: $115.76 |

| 52 Week Low: $77.01 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

3.14% |

4.05% |

| 12 Week |

0.29% |

0.17% |

| Year To Date |

0.75% |

0.26% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Christian H. Hillabrant - President; Chief Executive Officer and Director

P. Robert Bartolo - Chairman

Sunit S. Patel - Executive Vice President and Chief Financial Offic

Robert S. Collins - Vice President and Controller

Jason Genrich - Director

|

|

Peer Information

Crown Castle Inc. (ARE)

Crown Castle Inc. (CUZ)

Crown Castle Inc. (FUR)

Crown Castle Inc. (NNN)

Crown Castle Inc. (FCH)

Crown Castle Inc. (CTO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REIT-EQTY TRUST -OTHER

Sector: Finance

CUSIP: 22822V101

SIC: 6798

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 436.07

Most Recent Split Date: (:1)

Beta: 0.96

Market Capitalization: $39,045.75 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.75% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.97 |

Indicated Annual Dividend: $4.25 |

| Current Fiscal Year EPS Consensus Estimate: $4.23 |

Payout Ratio: 0.97 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.14 |

| Estmated Long-Term EPS Growth Rate: 46.70% |

Last Dividend Paid: 12/15/2025 - $1.06 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |