| Zacks Company Profile for Carnival Corporation (CCL : NYSE) |

|

|

| |

| • Company Description |

| Carnival Corporation operates as a cruise and vacation company. As a single economic entity, Carnival Corporation & Carnival plc forms the largest cruise operator in the world. Carnival is the world's leading leisure travel firm and carries nearly half of the global cruise guests. The company has operations on North America, Australia, Europe and Asia. The company's cruise brand includes s Carnival Cruise Line, Princess Cruises, Holland America Line, Seabourn, P&O Cruises (Australia), Costa Cruises, AIDA Cruises, P&O Cruises (UK) and Cunard.

Number of Employees: 101,000 |

|

|

| |

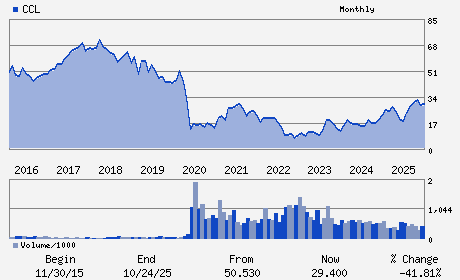

| • Price / Volume Information |

| Yesterday's Closing Price: $31.55 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 19,782,334 shares |

| Shares Outstanding: 1,236.71 (millions) |

| Market Capitalization: $39,018.09 (millions) |

| Beta: 2.42 |

| 52 Week High: $34.03 |

| 52 Week Low: $15.07 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

5.10% |

6.02% |

| 12 Week |

21.96% |

21.81% |

| Year To Date |

3.31% |

2.81% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

3655 N W 87TH AVE PO BOX 1347

-

MIAMI,FL 33178

USA |

ph: 305-599-2600

fax: 305-399-4696 |

None |

http://www.carnivalcorp.com |

|

|

| |

| • General Corporate Information |

Officers

Josh Weinstein - Chief Executive Officer and Director

Micky Arison - Chair of the Board of Directors

David Bernstein - Chief Financial Officer and Chief Accounting Offic

Jonathon Band - Director

Jason Glen Cahilly - Director

|

|

Peer Information

Carnival Corporation (KJFI)

Carnival Corporation (MBEW)

Carnival Corporation (DVD)

Carnival Corporation (GCCXQ)

Carnival Corporation (AMIEQ)

Carnival Corporation (FAIR)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: LEISURE&REC SVS

Sector: Consumer Discretionary

CUSIP: 143658300

SIC: 4400

|

|

Fiscal Year

Fiscal Year End: November

Last Reported Quarter: 11/01/25

Next Expected EPS Date: 03/20/26

|

|

Share - Related Items

Shares Outstanding: 1,236.71

Most Recent Split Date: 6.00 (2.00:1)

Beta: 2.42

Market Capitalization: $39,018.09 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.90% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.17 |

Indicated Annual Dividend: $0.60 |

| Current Fiscal Year EPS Consensus Estimate: $2.54 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 9.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 10.79% |

Last Dividend Paid: 02/13/2026 - $0.15 |

| Next EPS Report Date: 03/20/26 |

|

|

|

| |