| Zacks Company Profile for Cogent Communications Holdings, Inc. (CCOI : NSDQ) |

|

|

| |

| • Company Description |

| Cogent Communications Holdings, Inc. is a Tier 1 Internet Service Provider that offers low-cost high-speed Internet access, private network services and colocation center services with ultra-low latency data transmission. The company provides its services to markets spanning across North America, Europe Asia, Latin America and Australia. It addresses the dynamic needs of various small and medium-sized businesses, ISPs and other bandwidth-intensive organizations. Cogent's network comprises metropolitan optical networks, in-building riser facilities, inter-city transport facilities and metropolitan traffic aggregation points. It transmits low cost packet switched traffic over a reliable and secure network compared with traditional circuit-switched telephone networks.

Number of Employees: 1,833 |

|

|

| |

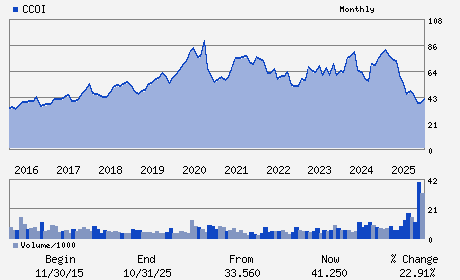

| • Price / Volume Information |

| Yesterday's Closing Price: $18.76 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,496,394 shares |

| Shares Outstanding: 50.06 (millions) |

| Market Capitalization: $939.17 (millions) |

| Beta: 0.84 |

| 52 Week High: $75.46 |

| 52 Week Low: $15.96 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-22.80% |

-22.12% |

| 12 Week |

-4.38% |

-4.50% |

| Year To Date |

-12.99% |

-13.41% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

David Schaeffer - Chairman and Chief Executive Officer

Thaddeus Weed - Vice President; Chief Financial Officer and Treasu

Paul De Sa - Director

Eve Howard - Director

Steven Brooks - Director

|

|

Peer Information

Cogent Communications Holdings, Inc. (UATG)

Cogent Communications Holdings, Inc. (ELWT)

Cogent Communications Holdings, Inc. (GSMI)

Cogent Communications Holdings, Inc. (LCCI)

Cogent Communications Holdings, Inc. (T)

Cogent Communications Holdings, Inc. (MCOMQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Wireless National

Sector: Computer and Technology

CUSIP: 19239V302

SIC: 4899

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 50.06

Most Recent Split Date: 3.00 (0.05:1)

Beta: 0.84

Market Capitalization: $939.17 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.43% |

| Current Fiscal Quarter EPS Consensus Estimate: $-1.04 |

Indicated Annual Dividend: $0.08 |

| Current Fiscal Year EPS Consensus Estimate: $-3.74 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 4.28% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |