| Zacks Company Profile for Cardlytics, Inc. (CDLX : NSDQ) |

|

|

| |

| • Company Description |

| Cardlytics, Inc. is engaged in developing a purchase intelligence platform. The purchase data includes debit, credit and bill pay data from online and in-store transactions. It helps the marketers identify, reach and influence likely buyers at scale, and measure the impact of marketing spends. The Company also operates an advertising channel, Cardlytics Direct. Cardlytics Direct delivers tailored marketing for marketers and financial institutions. Cardlytics, Inc. is based in ATLANTA, United States.

Number of Employees: 454 |

|

|

| |

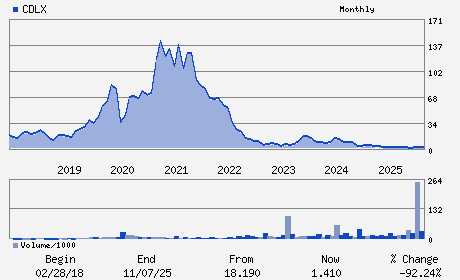

| • Price / Volume Information |

| Yesterday's Closing Price: $0.86 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 635,765 shares |

| Shares Outstanding: 54.06 (millions) |

| Market Capitalization: $46.71 (millions) |

| Beta: 1.03 |

| 52 Week High: $3.28 |

| 52 Week Low: $0.80 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-10.78% |

-10.00% |

| 12 Week |

-21.44% |

-21.54% |

| Year To Date |

-24.86% |

-25.23% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Amit Gupta - Chief Executive Officer and Director

John Klinck - Chairman

Alexis DeSieno - Chief Financial Officer

Andre Fernandez - Director

Jon Francis - Director

|

|

Peer Information

Cardlytics, Inc. (EVOL)

Cardlytics, Inc. (RAMP)

Cardlytics, Inc. (LGTY)

Cardlytics, Inc. (ALOT)

Cardlytics, Inc. (CXT)

Cardlytics, Inc. (TGHI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Technology Services

Sector: Business Services

CUSIP: 14161W105

SIC: 7370

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/04/26

|

|

Share - Related Items

Shares Outstanding: 54.06

Most Recent Split Date: (:1)

Beta: 1.03

Market Capitalization: $46.71 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.33 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 19.17% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/04/26 |

|

|

|

| |