| Zacks Company Profile for Cadence Design Systems, Inc. (CDNS : NSDQ) |

|

|

| |

| • Company Description |

| Cadence Design Systems Inc. offers products and tools that help customers to design electronic products. Through System Design Enablement (SDE) strategy the company offers software, hardware, services and reusable IC design blocks (IPs) to electronic systems and semiconductor customers.Cadence's core electronic design automation (EDA) software and services enable engineers to develop different types of ICs. Its design IP's are directly integrated into the ICs.System Connect tools and services are used for the design, analysis and verification of PCBs. Further, System Integration solutions aid in designing and analyzing systems as well as verifying system functionality.

Number of Employees: 13,800 |

|

|

| |

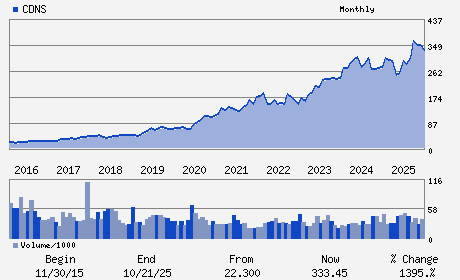

| • Price / Volume Information |

| Yesterday's Closing Price: $301.40 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,273,666 shares |

| Shares Outstanding: 272.65 (millions) |

| Market Capitalization: $82,177.01 (millions) |

| Beta: 1.00 |

| 52 Week High: $376.45 |

| 52 Week Low: $221.56 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.70% |

2.59% |

| 12 Week |

-10.70% |

-10.81% |

| Year To Date |

-3.58% |

-4.04% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Anirudh Devgan - Chief Executive Officer

ML Krakauer - Chairman

John M. Wall - Senior Vice President and Chief Financial Officer

Karna Nisewaner - Senior Vice President; General Counsel and Corpora

Moshe Gavrielov - Director

|

|

Peer Information

Cadence Design Systems, Inc. (ATEA)

Cadence Design Systems, Inc. (BITS.)

Cadence Design Systems, Inc. (DCTM)

Cadence Design Systems, Inc. (DLVAZ)

Cadence Design Systems, Inc. (DOCC)

Cadence Design Systems, Inc. (NEON)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: COMP-SOFTWARE

Sector: Computer and Technology

CUSIP: 127387108

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/27/26

|

|

Share - Related Items

Shares Outstanding: 272.65

Most Recent Split Date: 11.00 (2.00:1)

Beta: 1.00

Market Capitalization: $82,177.01 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.52 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $6.54 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 12.80% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/27/26 |

|

|

|

| |