| Zacks Company Profile for Cadre Holdings, Inc. (CDRE : NYSE) |

|

|

| |

| • Company Description |

| Cadre Holdings Inc. is a manufacturer and distributer of safety and survivability equipment for first responders. The Company's core products include body armor, explosive ordnance disposal equipment and duty gear. Its primarily brands include Safariland(R) and Med-Eng(R). Cadre Holdings Inc. is headquartered in Jacksonville, Florida.

Number of Employees: 2,284 |

|

|

| |

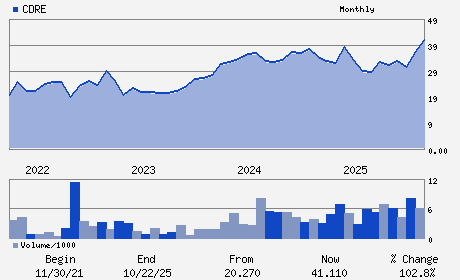

| • Price / Volume Information |

| Yesterday's Closing Price: $44.39 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 168,213 shares |

| Shares Outstanding: 40.66 (millions) |

| Market Capitalization: $1,805.07 (millions) |

| Beta: 1.34 |

| 52 Week High: $46.64 |

| 52 Week Low: $27.07 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

10.95% |

11.92% |

| 12 Week |

3.59% |

3.47% |

| Year To Date |

8.69% |

8.16% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Warren B. Kanders - Chief Executive Officer

Blaine Browers - Chief Financial Officer

Hamish Norton - Director

Gianmaria C. Delzanno - Director

William Quigley - Director

|

|

Peer Information

Cadre Holdings, Inc. (BRC)

Cadre Holdings, Inc. (ALGI)

Cadre Holdings, Inc. (SYNX.)

Cadre Holdings, Inc. (ADSV)

Cadre Holdings, Inc. (CDCY)

Cadre Holdings, Inc. (CSCQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: PROTECTION-SFTY

Sector: Industrial Products

CUSIP: 12763L105

SIC: 3842

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/10/26

|

|

Share - Related Items

Shares Outstanding: 40.66

Most Recent Split Date: (:1)

Beta: 1.34

Market Capitalization: $1,805.07 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.90% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.40 |

| Current Fiscal Year EPS Consensus Estimate: $1.33 |

Payout Ratio: 0.34 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: -0.37 |

| Estmated Long-Term EPS Growth Rate: 22.39% |

Last Dividend Paid: 01/30/2026 - $0.10 |

| Next EPS Report Date: 03/10/26 |

|

|

|

| |