| Zacks Company Profile for Chegg, Inc. (CHGG : NYSE) |

|

|

| |

| • Company Description |

| Chegg, Inc. is a student-first online learning platform that supports millions of learners around the world with study help, math help, writing help, practice problems, flashcards, access to books and etextbooks, and more. Chegg also supports life-long learners from school into their careers with personal and professional development skills training, via Chegg Skills.

Number of Employees: 1,271 |

|

|

| |

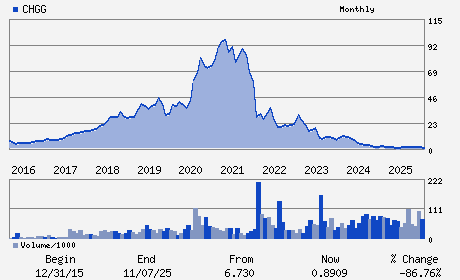

| • Price / Volume Information |

| Yesterday's Closing Price: $0.66 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,495,994 shares |

| Shares Outstanding: 109.27 (millions) |

| Market Capitalization: $71.82 (millions) |

| Beta: 1.99 |

| 52 Week High: $1.90 |

| 52 Week Low: $0.44 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-14.52% |

-13.78% |

| 12 Week |

-26.15% |

-26.24% |

| Year To Date |

-29.32% |

-29.67% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

3990 FREEDOM CIRCLE

-

SANTA CLARA,CA 95054

USA |

ph: 408-855-5700

fax: - |

ir@chegg.com |

http://www.chegg.com |

|

|

| |

| • General Corporate Information |

Officers

Nathan Schultz - President; Chief Executive Officer

Dan Rosensweig - Co-Chairperson and Executive Chairman

Richard Sarnoff - Co-Chairperson

Dan Rosensweig - Chief Financial Officer

Renee Budig - Director

|

|

Peer Information

Chegg, Inc. (ADP)

Chegg, Inc. (CWLD)

Chegg, Inc. (CYBA.)

Chegg, Inc. (ZVLO)

Chegg, Inc. (AZPN)

Chegg, Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 163092109

SIC: 8200

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/11/26

|

|

Share - Related Items

Shares Outstanding: 109.27

Most Recent Split Date: (:1)

Beta: 1.99

Market Capitalization: $71.82 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.01 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.29 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/11/26 |

|

|

|

| |