| Zacks Company Profile for Choice Hotels International, Inc. (CHH : NYSE) |

|

|

| |

| • Company Description |

| Choice Hotels International is one of the largest hotel franchisors globally. This hotel chain is spread in more than 35 countries. Comfort Inn, Comfort Suites, Quality, Clarion, Clarion Pointe, Sleep Inn, Econo Lodge, Rodeway Inn, MainStay Suites, Suburban Extended Stay Hotel, WoodSpring Suites, Everhome Suites, Cambria Hotels, and Ascend Hotel Collection are the company's proprietary brand names. The company announced the launch of Everhome Suites, a new-construction midscale extended-stay brand offering. Choice Hotel's primary business segment is hotel franchising. While domestic franchising operations are conducted through direct franchising relationships, international franchise operations are carried out via a combination of direct and master franchising relationships. Choice Hotels brands' including WoodSpring Suites, Suburban Extended Stay, MainStay Suites and Everhome Suites, have performed significantly well amid the ongoing crisis.

Number of Employees: 1,700 |

|

|

| |

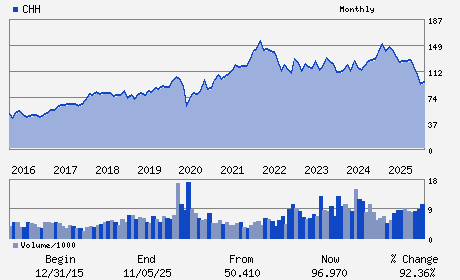

| • Price / Volume Information |

| Yesterday's Closing Price: $105.35 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 620,272 shares |

| Shares Outstanding: 45.97 (millions) |

| Market Capitalization: $4,843.09 (millions) |

| Beta: 0.75 |

| 52 Week High: $147.51 |

| 52 Week Low: $84.04 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

2.48% |

3.38% |

| 12 Week |

22.84% |

22.69% |

| Year To Date |

10.59% |

10.06% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Patrick S. Pacious - Chief Executive Officer;President and Director

Stewart W. Bainum, Jr. - Chairman; Director

Scott E. Oaksmith - Chief Financial Officer

William L. Jews - Director

Brian B. Bainum - Director

|

|

Peer Information

Choice Hotels International, Inc. (HOT.)

Choice Hotels International, Inc. (CHH)

Choice Hotels International, Inc. (ESA.)

Choice Hotels International, Inc. (GPSRY)

Choice Hotels International, Inc. (FS)

Choice Hotels International, Inc. (CLMDY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: HOTELS & MOTELS

Sector: Consumer Discretionary

CUSIP: 169905106

SIC: 7011

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 45.97

Most Recent Split Date: 10.00 (2.00:1)

Beta: 0.75

Market Capitalization: $4,843.09 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.09% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.34 |

Indicated Annual Dividend: $1.15 |

| Current Fiscal Year EPS Consensus Estimate: $7.25 |

Payout Ratio: 0.17 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: 3.12% |

Last Dividend Paid: 01/02/2026 - $0.29 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |