| Zacks Company Profile for CHOW TAI FOOK (CJEWY : OTC) |

|

|

| |

| • Company Description |

| Chow Tai Fook Jewellery Group manufactures and sells jewelry products. The Company sells rings, necklaces, earrings, pendants, bracelets and small statues. It operates primarily in China, Hong Kong, Macau, Taiwan, Malaysia and Singapore. Chow Tai Fook Jewellery Group is headquartered in Central, Hong Kong.

Number of Employees: 25,900 |

|

|

| |

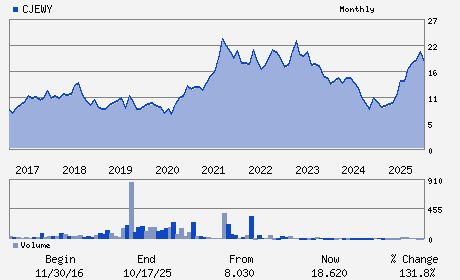

| • Price / Volume Information |

| Yesterday's Closing Price: $18.55 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 13 shares |

| Shares Outstanding: 986.49 (millions) |

| Market Capitalization: $18,299.47 (millions) |

| Beta: 0.22 |

| 52 Week High: $21.00 |

| 52 Week Low: $10.25 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.00% |

1.38% |

| 12 Week |

3.06% |

2.53% |

| Year To Date |

12.05% |

11.46% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Cheng Kar-Shun, Henry - Chairman

Cheng Chi-Heng, Conroy - Vice-chairman

Wong Siu-Kee, Kent - Director

Cheng Kam-Biu,Wilson - Director

Wong Siu-Kee - Director

|

|

Peer Information

CHOW TAI FOOK (KGJI)

CHOW TAI FOOK (JEWL)

CHOW TAI FOOK (OROA)

CHOW TAI FOOK (RJI.)

CHOW TAI FOOK (SIG)

CHOW TAI FOOK (ELA)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-JEWELRY

Sector: Retail/Wholesale

CUSIP: 17044P106

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: -

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding: 986.49

Most Recent Split Date: (:1)

Beta: 0.22

Market Capitalization: $18,299.47 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.44% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.45 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/16/2025 - $0.23 |

| Next EPS Report Date: - |

|

|

|

| |