| Zacks Company Profile for Colgate-Palmolive Company (CL : NYSE) |

|

|

| |

| • Company Description |

| Colgate-Palmolive is a global leader in the oral care hygiene market. It produces and distributions household, healthcare and personal care products. Company's business strategy closely defines efforts to increase its leadership in key product categories through innovation in core businesses, tracking adjacent categories growth and expansion into new markets and channels. Due to the shift of consumer preference to organic and natural ingredients, the company is expanding its Naturals range. Its business is focused on four core categories including - Oral Care, Personal Care, Pet Nutrition and Home Care. Colgate-Palmolive operates through two business segments: (1) Oral, Personal and Home Care; and (2) Pet Nutrition. Oral, Personal and Home Care. The pet nutrition segment consists of pet food products for dogs and cats manufactured by Colgate-Palmolive's subsidiary, Hill's Pet Nutrition.

Number of Employees: 33,600 |

|

|

| |

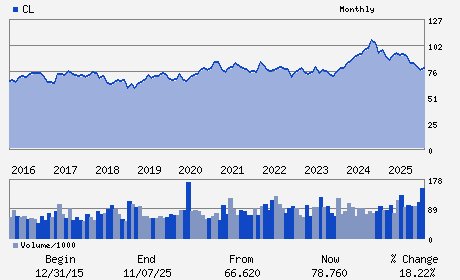

| • Price / Volume Information |

| Yesterday's Closing Price: $99.14 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 6,515,493 shares |

| Shares Outstanding: 806.07 (millions) |

| Market Capitalization: $79,913.28 (millions) |

| Beta: 0.28 |

| 52 Week High: $100.18 |

| 52 Week Low: $74.55 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

9.80% |

10.76% |

| 12 Week |

26.99% |

26.83% |

| Year To Date |

25.46% |

24.85% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Noel Wallace - Chairman; President and Chief Executive Officer

Stanley J. Sutula III - Chief Financial Officer

Gregory O. Malcolm - Executive Vice President; Controller

John P. Bilbrey - Director

John T. Cahill - Director

|

|

Peer Information

Colgate-Palmolive Company (EPC)

Colgate-Palmolive Company (HPPS)

Colgate-Palmolive Company (ADRNY)

Colgate-Palmolive Company (YHGJ)

Colgate-Palmolive Company (GPSYY)

Colgate-Palmolive Company (HENKY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CONS PD- MISC STPL

Sector: Consumer Staples

CUSIP: 194162103

SIC: 2844

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/24/26

|

|

Share - Related Items

Shares Outstanding: 806.07

Most Recent Split Date: 5.00 (2.00:1)

Beta: 0.28

Market Capitalization: $79,913.28 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.10% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.95 |

Indicated Annual Dividend: $2.08 |

| Current Fiscal Year EPS Consensus Estimate: $3.90 |

Payout Ratio: 0.56 |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: 5.69% |

Last Dividend Paid: 01/21/2026 - $0.52 |

| Next EPS Report Date: 04/24/26 |

|

|

|

| |