| Zacks Company Profile for Traeger, Inc. (COOK : NYSE) |

|

|

| |

| • Company Description |

| Traeger Inc. provides wood pellet grill. The company's pellet grills utilize wood-fired convection power, owners can grill, smoke, bake, roast, braise and barbecue meals on one cooking system. Traeger Inc. is headquartered in Salt Lake City.

Number of Employees: 666 |

|

|

| |

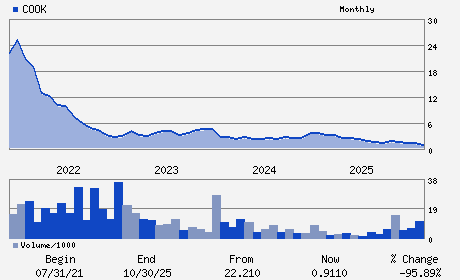

| • Price / Volume Information |

| Yesterday's Closing Price: $0.86 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 255,508 shares |

| Shares Outstanding: 137.18 (millions) |

| Market Capitalization: $117.97 (millions) |

| Beta: 1.41 |

| 52 Week High: $2.42 |

| 52 Week Low: $0.71 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-21.82% |

-21.14% |

| 12 Week |

7.93% |

7.80% |

| Year To Date |

-20.37% |

-20.76% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Jeremy Andrus - Chief Executive Officer; Chairman

Jim Hardy - President of MEATER

Dominic Blosil - Chief Financial Officer

Wendy A. Beck - Director

Martin Eltrich - Director

|

|

Peer Information

Traeger, Inc. (LENXQ)

Traeger, Inc. (BFXXQ)

Traeger, Inc. (CENT)

Traeger, Inc. (FTDL)

Traeger, Inc. (BTH)

Traeger, Inc. (JAH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CONSM PD-MISC DIS

Sector: Consumer Discretionary

CUSIP: 89269P103

SIC: 3630

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/05/26

|

|

Share - Related Items

Shares Outstanding: 137.18

Most Recent Split Date: (:1)

Beta: 1.41

Market Capitalization: $117.97 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.01 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.05 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/05/26 |

|

|

|

| |