| Zacks Company Profile for Costco Wholesale Corporation (COST : NSDQ) |

|

|

| |

| • Company Description |

| Costco Wholesale Corporation sells high volumes of foods and general merchandise at discounted prices through membership warehouses. The company also operates e-commerce websites in the United States, Canada, the United Kingdom, Mexico, Korea, Taiwan, Japan and Australia. The company's warehouses offer an array of low-priced nationally branded and select private labeled products in a wide range of merchandise categories. Costco offers three types of memberships to its customers: Business, Gold Star, and Executive. Costco generates revenue from two sources: 1) Store sales and 2) Membership fees. Costco offers myriad varieties of food products as well as a vast range of household and lifestyle products, stationeries and appliances. The company also sells gasoline to customers at cheap prices and offers merchandise in the following categories: Food and Sundries, Hardlines, Fresh Foods, Softlines, Ancillary.

Number of Employees: 341,000 |

|

|

| |

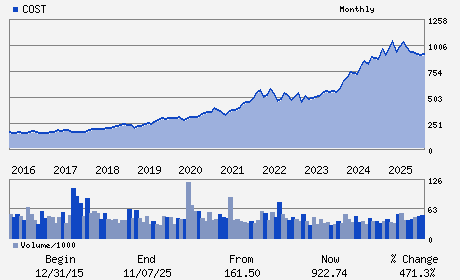

| • Price / Volume Information |

| Yesterday's Closing Price: $1,002.77 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,074,827 shares |

| Shares Outstanding: 443.87 (millions) |

| Market Capitalization: $445,098.94 (millions) |

| Beta: 1.01 |

| 52 Week High: $1,067.08 |

| 52 Week Low: $844.06 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

3.55% |

4.98% |

| 12 Week |

12.99% |

12.41% |

| Year To Date |

16.28% |

15.67% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Ron M. Vachris - Chief Executive Officer; President and Director

Hamilton E. James - Chairman of the Board

Gary Millerchip - Executive Vice President and Chief Financial Offic

Tiffany M. Barbre - Senior Vice President and Corporate Controller

Susan L. Decker - Director

|

|

Peer Information

Costco Wholesale Corporation (TGT)

Costco Wholesale Corporation (BURL)

Costco Wholesale Corporation (ALCSQ)

Costco Wholesale Corporation (CLDRQ)

Costco Wholesale Corporation (BLEEQ)

Costco Wholesale Corporation (FDO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-DISCOUNT

Sector: Retail/Wholesale

CUSIP: 22160K105

SIC: 5331

|

|

Fiscal Year

Fiscal Year End: August

Last Reported Quarter: 11/01/25

Next Expected EPS Date: 03/05/26

|

|

Share - Related Items

Shares Outstanding: 443.87

Most Recent Split Date: 1.00 (2.00:1)

Beta: 1.01

Market Capitalization: $445,098.94 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.52% |

| Current Fiscal Quarter EPS Consensus Estimate: $4.88 |

Indicated Annual Dividend: $5.20 |

| Current Fiscal Year EPS Consensus Estimate: $20.23 |

Payout Ratio: 0.28 |

| Number of Estimates in the Fiscal Year Consensus: 12.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 10.31% |

Last Dividend Paid: 01/30/2026 - $1.30 |

| Next EPS Report Date: 03/05/26 |

|

|

|

| |