| Zacks Company Profile for Charles River Laboratories International, Inc. (CRL : NYSE) |

|

|

| |

| • Company Description |

| Charles River Laboratories International, Inc. is a full service, early-stage contract research organization. The company provides essential products and services to help pharmaceutical and biotechnology companies, government agencies and leading academic institutions globally accelerate their research and drug development efforts. The company has a diverse portfolio of discovery and safety assessment services, both Good Laboratory Practice (GLP) and non-GLP. This helps support its clients from target identification through non-clinical development. Charles River also provides a line of products and services to support clients' manufacturing activities. Utilizing the company's broad portfolio of products and services, clients can create a more flexible drug development model, aiming cost reduction, productivity enhancement and increase in speed to market. Charles River currently has three reporting segments: Research Models and Services (RMS), Discovery and Safety Assessment (DSA) and Manufacturing Support.

Number of Employees: 19,700 |

|

|

| |

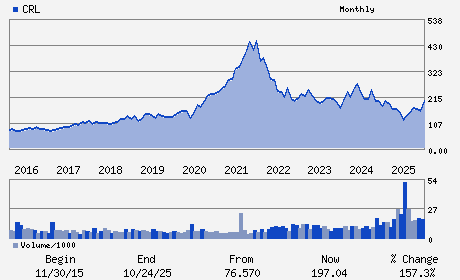

| • Price / Volume Information |

| Yesterday's Closing Price: $178.49 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,323,794 shares |

| Shares Outstanding: 49.23 (millions) |

| Market Capitalization: $8,786.67 (millions) |

| Beta: 1.64 |

| 52 Week High: $228.88 |

| 52 Week Low: $91.86 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-15.20% |

-14.46% |

| 12 Week |

-3.16% |

-3.28% |

| Year To Date |

-10.52% |

-10.96% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

James C. Foster - Chairman; President and Chief Executive Officer

Michael G. Knell - Chief Financial Officer; Corporate Senior Vice Pre

Nancy C. Andrews - Director

Steven Barg - Director

Abraham Ceesay - Director

|

|

Peer Information

Charles River Laboratories International, Inc. (CHCR)

Charles River Laboratories International, Inc. (ESRX)

Charles River Laboratories International, Inc. (MYDP)

Charles River Laboratories International, Inc. (COR)

Charles River Laboratories International, Inc. (GBCS)

Charles River Laboratories International, Inc. (LAXAF)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Medical Services

Sector: Medical

CUSIP: 159864107

SIC: 8731

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 49.23

Most Recent Split Date: (:1)

Beta: 1.64

Market Capitalization: $8,786.67 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.05 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $10.95 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 5.34% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |