| Zacks Company Profile for Cisco Systems, Inc. (CSCO : NSDQ) |

|

|

| |

| • Company Description |

| Cisco Systems Inc. is an IP-based networking company offering products and services to service providers, companies, commercial users and individuals. Cisco is rapidly expanding its presence in network security domain. Security includes products and services preventing unauthorized access to system resources and protecting from worms, spam, viruses and other malware. The Data Center product category includes Cisco Unified Computing System (UCS) and Server Access Virtualization. It also comprises of The Other products segment and Related Services.The company offers identity and access, advanced threat, and unified threat management solutions. The company has introduced Secure Remote Worker, which leverages Zero Trust Architecture, combined with robust endpoint security portfolio of AnyConnect, Umbrella, Duo and AMP for Endpoints.Cisco provides Next-Generation Network (NGN) Routers, that transport data, voice and video information from one IP network to another.

Number of Employees: 86,200 |

|

|

| |

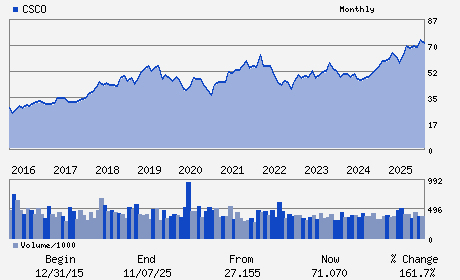

| • Price / Volume Information |

| Yesterday's Closing Price: $79.46 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 27,937,392 shares |

| Shares Outstanding: 3,949.89 (millions) |

| Market Capitalization: $313,858.50 (millions) |

| Beta: 0.87 |

| 52 Week High: $88.19 |

| 52 Week Low: $52.11 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.46% |

2.34% |

| 12 Week |

1.91% |

1.79% |

| Year To Date |

3.15% |

2.65% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

170 WEST TASMAN DRIVE

-

SAN JOSE,CA 95134

USA |

ph: 408-526-4000

fax: 408-853-3683 |

sambadri@cisco.com |

http://www.cisco.com |

|

|

| |

| • General Corporate Information |

Officers

Charles H. Robbins - Chairman and Chief Executive Officer

Mark Patterson - Executive Vice President and Chief Financial Offic

M. Victoria Wong - Senior Vice President and Chief Accounting Officer

Wesley G. Bush - Director

Mark Garrett - Director

|

|

Peer Information

Cisco Systems, Inc. (CSTL2)

Cisco Systems, Inc. (DDDDF)

Cisco Systems, Inc. (BCSI)

Cisco Systems, Inc. (CRDSQ)

Cisco Systems, Inc. (BRCD)

Cisco Systems, Inc. (FKWL)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: COMP-NETWORKS

Sector: Computer and Technology

CUSIP: 17275R102

SIC: 3576

|

|

Fiscal Year

Fiscal Year End: July

Last Reported Quarter: 01/01/26

Next Expected EPS Date: 05/13/26

|

|

Share - Related Items

Shares Outstanding: 3,949.89

Most Recent Split Date: 3.00 (2.00:1)

Beta: 0.87

Market Capitalization: $313,858.50 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.06% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.85 |

Indicated Annual Dividend: $1.64 |

| Current Fiscal Year EPS Consensus Estimate: $3.39 |

Payout Ratio: 0.50 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 7.80% |

Last Dividend Paid: 01/02/2026 - $0.41 |

| Next EPS Report Date: 05/13/26 |

|

|

|

| |