| Zacks Company Profile for Community Trust Bancorp, Inc. (CTBI : NSDQ) |

|

|

| |

| • Company Description |

| Community Trust Financial Services Corporation was incorporated under the laws for the purpose of becoming a bank holding company for Community Trust Bank. The Company is intended to facilitate the Bank's ability to serve its customers' requirements for financial services. The primary activity of the Company currently is, and is expected to remain for the foreseeable future, the ownership and operation of the Bank.

Number of Employees: 934 |

|

|

| |

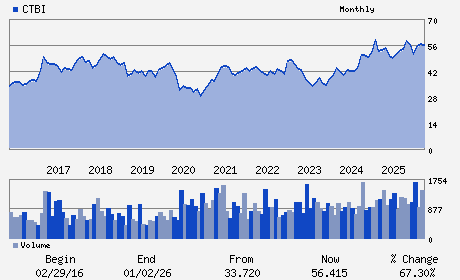

| • Price / Volume Information |

| Yesterday's Closing Price: $60.04 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 63,663 shares |

| Shares Outstanding: 18.12 (millions) |

| Market Capitalization: $1,087.68 (millions) |

| Beta: 0.57 |

| 52 Week High: $65.79 |

| 52 Week Low: $44.60 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-2.69% |

-1.84% |

| 12 Week |

5.11% |

4.98% |

| Year To Date |

6.27% |

5.75% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

346 NORTH MAYO TRAIL P.O. BOX 2947

-

PIKEVILLE,KY 41502

USA |

ph: 606-432-1414

fax: 606-437-3366 |

goochma@ctbi.com |

http://www.ctbi.com |

|

|

| |

| • General Corporate Information |

Officers

Mark A. Gooch - Chief Executive Officer; Chairman and President

Kevin J. Stumbo - Executive Vice President; Chief Financial Officer

Franklin H. Farris, Jr. - Director

Eugenia Crit Luallen - Director

Ina Michelle Matthews - Director

|

|

Peer Information

Community Trust Bancorp, Inc. (TSFG)

Community Trust Bancorp, Inc. (ABCB)

Community Trust Bancorp, Inc. (CFNL)

Community Trust Bancorp, Inc. (CPKF)

Community Trust Bancorp, Inc. (HIB)

Community Trust Bancorp, Inc. (FVB)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-SOUTHEAST

Sector: Finance

CUSIP: 204149108

SIC: 6022

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/15/26

|

|

Share - Related Items

Shares Outstanding: 18.12

Most Recent Split Date: 5.00 (1.10:1)

Beta: 0.57

Market Capitalization: $1,087.68 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.53% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.38 |

Indicated Annual Dividend: $2.12 |

| Current Fiscal Year EPS Consensus Estimate: $5.78 |

Payout Ratio: 0.39 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.01 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/15/2025 - $0.53 |

| Next EPS Report Date: 04/15/26 |

|

|

|

| |