| Zacks Company Profile for Cognizant Technology Solutions Corporation (CTSH : NSDQ) |

|

|

| |

| • Company Description |

| Cognizant Technology Solutions Corporation is a leading professional services company. It offers digital services and solutions, consulting, application development, systems integration, application testing, application maintenance, infrastructure services and business process services. The company is focusing its investments on four key areas of digital: IoT, AI, experience-driven software engineering and cloud. The company primarily serves four domains: Financial Services, Healthcare, Products & Resources and Communications, Media & Technology.

Number of Employees: 351,600 |

|

|

| |

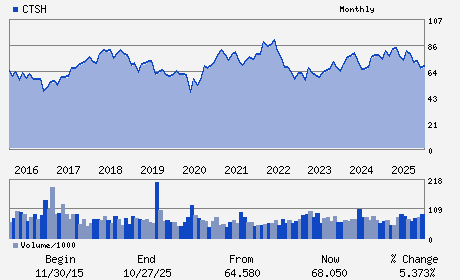

| • Price / Volume Information |

| Yesterday's Closing Price: $64.43 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 9,218,477 shares |

| Shares Outstanding: 478.25 (millions) |

| Market Capitalization: $30,813.45 (millions) |

| Beta: 1.00 |

| 52 Week High: $87.03 |

| 52 Week Low: $60.04 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-21.48% |

-20.80% |

| 12 Week |

-20.18% |

-20.28% |

| Year To Date |

-22.37% |

-22.75% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Ravi Kumar S - Chief Executive Officer

Stephen J. Rohleder - Chairman

Jatin Dalal - Chief Financial Officer

Alina Kerdman - Senior Vice President; Controller and Chief Accoun

Zein Abdalla - Director

|

|

Peer Information

Cognizant Technology Solutions Corporation (UIS)

Cognizant Technology Solutions Corporation (CTSH)

Cognizant Technology Solutions Corporation (ASGN)

Cognizant Technology Solutions Corporation (GTTNQ)

Cognizant Technology Solutions Corporation (DXC)

Cognizant Technology Solutions Corporation (DOX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: IT Services

Sector: Computer and Technology

CUSIP: 192446102

SIC: 7371

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 478.25

Most Recent Split Date: 3.00 (2.00:1)

Beta: 1.00

Market Capitalization: $30,813.45 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.05% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.34 |

Indicated Annual Dividend: $1.32 |

| Current Fiscal Year EPS Consensus Estimate: $5.66 |

Payout Ratio: 0.23 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: 8.15% |

Last Dividend Paid: 02/18/2026 - $0.33 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |