| Zacks Company Profile for Customers Bancorp, Inc (CUBI : NYSE) |

|

|

| |

| • Company Description |

| Customers Bancorp is a bank holding company of Customers Bank, a state-chartered bank in Pennsylvania. It provides banking services to small and medium-sized businesses, professionals, individuals and families. The company offers depository products, commercial lending products, specialty lending products and consumer lending. In addition, the company offers other financial services, including Internet banking, wire transfers, electronic bill payment, lock box, remote deposit capture, courier services, merchant processing, cash vault, controlled disbursements, and positive pay services, as well as cash management services comprising account reconciliation, collections, and sweep accounts. The bank has its branches in Pennsylvania, New York and New Jersey. Customers Bancorp is headquartered in Wyomissing, Pennsylvania.

Number of Employees: 793 |

|

|

| |

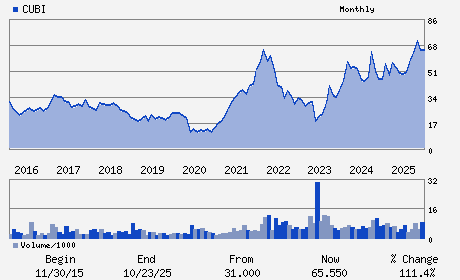

| • Price / Volume Information |

| Yesterday's Closing Price: $67.44 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 420,973 shares |

| Shares Outstanding: 34.17 (millions) |

| Market Capitalization: $2,304.29 (millions) |

| Beta: 1.66 |

| 52 Week High: $82.56 |

| 52 Week Low: $40.75 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-14.65% |

-13.91% |

| 12 Week |

-4.95% |

-5.06% |

| Year To Date |

-7.77% |

-8.22% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Jay S. Sidhu - Chairman and Chief Executive Officer

Philip S. Watkins - Executive Vice President and Chief Financial Offic

Jessie John D. Velasquez - Executive Vice President and Chief Accounting Offi

Andrea R. Allon - Director

Bernard B. Banks - Director

|

|

Peer Information

Customers Bancorp, Inc (TSFG)

Customers Bancorp, Inc (ABCB)

Customers Bancorp, Inc (CFNL)

Customers Bancorp, Inc (CPKF)

Customers Bancorp, Inc (HIB)

Customers Bancorp, Inc (FVB)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-SOUTHEAST

Sector: Finance

CUSIP: 23204G100

SIC: 6022

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/23/26

|

|

Share - Related Items

Shares Outstanding: 34.17

Most Recent Split Date: 5.00 (1.10:1)

Beta: 1.66

Market Capitalization: $2,304.29 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.91 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $8.33 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/23/26 |

|

|

|

| |