| Zacks Company Profile for Consolidated Water Co. Ltd. (CWCO : NSDQ) |

|

|

| |

| • Company Description |

| Consolidated Water Co. is involved in the development and operation of sea-water desalination plants and water distribution systems in water-scarce areas. Consolidated Water has 4 business segments: Retail, Bulk, Services and Manufacturing. Under Retail Water Operations, the company produces and supplies water to end users, including residential, commercial & government customers in the Cayman Islands.?It operates a desalination plant in Bali, Indonesia that sells water to resort and residential properties. Under Bulk Water Operations, the company produces and supplies water to government-owned distributors in the Cayman Islands and The Bahamas. Its services operations provide engineering and management services, which include design and construction as well as management and operation of desalination plants. Under Manufacturing operations, the company manufactures and provides a wide range of water-related products and gives design, engineering, management, operating and other services to various industries.

Number of Employees: 307 |

|

|

| |

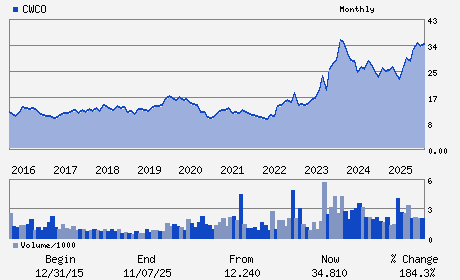

| • Price / Volume Information |

| Yesterday's Closing Price: $38.03 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 79,057 shares |

| Shares Outstanding: 15.93 (millions) |

| Market Capitalization: $605.87 (millions) |

| Beta: 0.50 |

| 52 Week High: $39.12 |

| 52 Week Low: $22.69 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-0.83% |

0.53% |

| 12 Week |

12.12% |

11.55% |

| Year To Date |

7.76% |

7.20% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Regatta Office Park Windward Three 4th Floor West Bay Road P.O. Box 1114

-

GRAND CAYMAN,E9 KY1-1102

CYM |

ph: 34-59-454-27

fax: 34-59-492-95 |

cwco@cma.team |

http://www.cwco.com |

|

|

| |

| • General Corporate Information |

Officers

Frederick W. McTaggart - Chief Executive Officer; President and Director

Wilmer F. Pergande - Chairman

David W. Sasnett - Executive Vice President & Chief Financial Officer

Linda Beidler-D'Aguilar - Director

Brian E. Butler - Director

|

|

Peer Information

Consolidated Water Co. Ltd. (VWTR)

Consolidated Water Co. Ltd. (WAAS)

Consolidated Water Co. Ltd. (CTWS)

Consolidated Water Co. Ltd. (CDZI)

Consolidated Water Co. Ltd. (PNNW)

Consolidated Water Co. Ltd. (AWR)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: UTIL-WATER SPLY

Sector: Utilities

CUSIP: G23773107

SIC: 4941

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/16/26

|

|

Share - Related Items

Shares Outstanding: 15.93

Most Recent Split Date: 8.00 (2.00:1)

Beta: 0.50

Market Capitalization: $605.87 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.47% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.41 |

Indicated Annual Dividend: $0.56 |

| Current Fiscal Year EPS Consensus Estimate: $1.57 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 01/02/2026 - $0.14 |

| Next EPS Report Date: 03/16/26 |

|

|

|

| |