| Zacks Company Profile for Cemex S.A.B. de C.V. (CX : NYSE) |

|

|

| |

| • Company Description |

| CEMEX is one of the largest cement companies in the world, with close to 78 million metric tons of production capacity. Through operating subsidiaries in four continents, they are engaged in the production, distribution, marketing and sale of cement, ready-mix concrete, aggregates and clinker. They are also the world's leading producer of white cement and the world's largest trader of cement and clinker.

Number of Employees: 45,649 |

|

|

| |

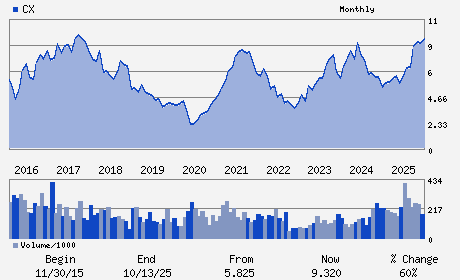

| • Price / Volume Information |

| Yesterday's Closing Price: $11.51 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 7,035,916 shares |

| Shares Outstanding: 1,449.09 (millions) |

| Market Capitalization: $16,678.99 (millions) |

| Beta: 1.61 |

| 52 Week High: $11.25 |

| 52 Week Low: $4.89 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

12.95% |

11.47% |

| 12 Week |

23.50% |

19.96% |

| Year To Date |

104.08% |

69.10% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

AVENIDA RICARDO MARGAIN ZOZAYA #325 COLONIA VALLE DEL CAMPESTRE

-

SAN PEDRO GARZA GARC?A,O5 66265

MEX |

ph: 52-81-8888-8888

fax: 52-81-8888-4483 |

ir@cemex.com |

http://www.cemex.com |

|

|

| |

| • General Corporate Information |

Officers

Jaime Muguiro Dominguez - Chief Executive Officer

Rogelio Zambrano Lozano - Executive Chairman

Maher Al-Haffar - Chief Financial Officer

Alfaro Alvarez - Director

Marcelo zambrano lozano - Director

|

|

Peer Information

Cemex S.A.B. de C.V. (DEVC)

Cemex S.A.B. de C.V. (CMTOY)

Cemex S.A.B. de C.V. (CEMTY)

Cemex S.A.B. de C.V. (T.LCI)

Cemex S.A.B. de C.V. (CNR.1)

Cemex S.A.B. de C.V. (HAN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG-CMT/CNT/AG

Sector: Construction

CUSIP: 151290889

SIC: 3241

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 02/05/26

|

|

Share - Related Items

Shares Outstanding: 1,449.09

Most Recent Split Date: 5.00 (1.04:1)

Beta: 1.61

Market Capitalization: $16,678.99 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.78% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.09 |

| Current Fiscal Year EPS Consensus Estimate: $0.94 |

Payout Ratio: 0.14 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.09 |

| Estmated Long-Term EPS Growth Rate: 9.51% |

Last Dividend Paid: 09/17/2025 - $0.02 |

| Next EPS Report Date: 02/05/26 |

|

|

|

| |