| Zacks Company Profile for Caesars Entertainment, Inc. (CZR : NSDQ) |

|

|

| |

| • Company Description |

| Caesars Entertainment, a diversified gaming and hospitality company, revenues through gaming operations that include mobile, online gaming and sports betting. It also utilizes its hotels, restaurants, bars, entertainment, racing, sportsbook offerings, retail shops and other services to attract customers to its properties. Its resorts operate primarily under the Caesars, Harrah's, Horseshoe and Eldorado brand names. Also, it has operations in countries across and outside the U.S. The operations occur in three regionally-focused reportable segments: Las Vegas, Regional, Caesars Digital and Managed & International, in addition to Corporate and Other. It has grown through development of new resorts, expansions and acquisitions. It owns, leases or manages an aggregate of domestic properties across states, comprising a large numbers of table games, slot machines, video lottery terminals and e-tables. Properties, like Harrah's Louisiana Downs, Caesars Southern Indiana and Caesars UK group met held for sale criteria.

Number of Employees: 21,000 |

|

|

| |

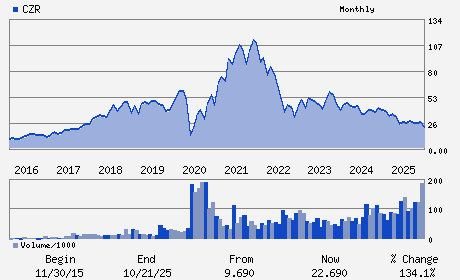

| • Price / Volume Information |

| Yesterday's Closing Price: $25.05 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 8,192,336 shares |

| Shares Outstanding: 203.52 (millions) |

| Market Capitalization: $5,098.20 (millions) |

| Beta: 1.94 |

| 52 Week High: $34.22 |

| 52 Week Low: $17.86 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

21.01% |

22.07% |

| 12 Week |

7.79% |

7.66% |

| Year To Date |

7.10% |

6.58% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Thomas R. Reeg - Chief Executive Officer and Director

Gary L. Carano - Executive Chairman

Bret Yunker - Chief Financial Officer

Stephanie D. Lepori - Chief Administrative and Accounting Officer

Bonnie Biumi - Director

|

|

Peer Information

Caesars Entertainment, Inc. (KJFI)

Caesars Entertainment, Inc. (MBEW)

Caesars Entertainment, Inc. (DVD)

Caesars Entertainment, Inc. (GCCXQ)

Caesars Entertainment, Inc. (AMIEQ)

Caesars Entertainment, Inc. (FAIR)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: LEISURE&REC SVS

Sector: Consumer Discretionary

CUSIP: 12769G100

SIC: 7011

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 203.52

Most Recent Split Date: (:1)

Beta: 1.94

Market Capitalization: $5,098.20 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.18 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.00 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 18.56% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |