| Zacks Company Profile for Datadog, Inc. (DDOG : NSDQ) |

|

|

| |

| • Company Description |

| Datadog Inc. is a monitoring and analytics platform for developers, IT operations teams and business users in the cloud age. The company's business runs around its portfolio of over 400 out-of-the-box integrations including public cloud, private cloud, on-premise hardware, databases and third-party software. The company's Software as a Service platform integrates and automates Infrastructure Monitoring, Application Performance Monitoring, Log Management, User Experience Monitoring, Network Performance Monitoring, Security Monitoring, Incident Management and Continuous Profiler that can be used individually or as a unified solution by customers. The company has a single operating and reportable segment. Solid uptake of its cloud-based monitoring and analytics platform also helped Datadog strengthen customer base. Datadog generates revenues from the sale of subscriptions to customers using its cloud-based platform.

Number of Employees: 8,100 |

|

|

| |

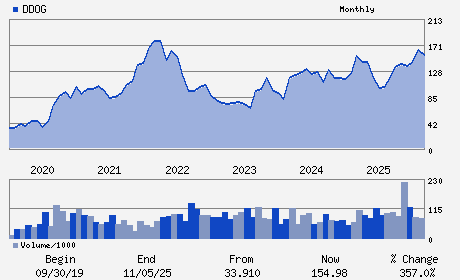

| • Price / Volume Information |

| Yesterday's Closing Price: $111.96 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 7,041,965 shares |

| Shares Outstanding: 352.58 (millions) |

| Market Capitalization: $39,474.42 (millions) |

| Beta: 1.31 |

| 52 Week High: $201.69 |

| 52 Week Low: $81.63 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-13.42% |

-12.67% |

| 12 Week |

-26.06% |

-26.15% |

| Year To Date |

-17.67% |

-18.07% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Olivier Pomel - Chief Executive Officer

David Obstler - Chief Financial Officer

Alexis Le-Quoc - Chief Technology Officer and Director

Amit Agarwal - Director

Michael Callahan - Director

|

|

Peer Information

Datadog, Inc. (ADP)

Datadog, Inc. (CWLD)

Datadog, Inc. (CYBA.)

Datadog, Inc. (ZVLO)

Datadog, Inc. (AZPN)

Datadog, Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 23804L103

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 352.58

Most Recent Split Date: (:1)

Beta: 1.31

Market Capitalization: $39,474.42 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.06 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.31 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 12.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 11.55% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |