| Zacks Company Profile for DHT Holdings, Inc. (DHT : NYSE) |

|

|

| |

| • Company Description |

| DHT MARITIME INC., formerly Double Hull Tankers, Inc. operates a fleet of double-hull crude oil tankers on international routes. DHT's modern fleet consists of three Very Large Crude Carriers, two Suezmax tankers and four Aframax tankers. DHT intends to pursue a strategy of providing shareholders with a stable and visible distribution and also position the Company to use its incremental cash flow to fund future growth opportunities.

Number of Employees: 924 |

|

|

| |

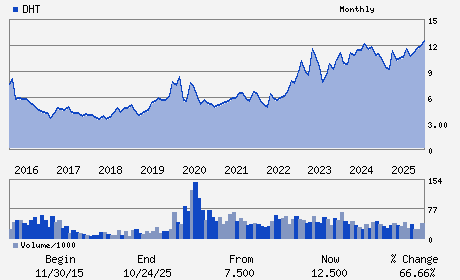

| • Price / Volume Information |

| Yesterday's Closing Price: $19.49 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,963,456 shares |

| Shares Outstanding: 160.61 (millions) |

| Market Capitalization: $3,130.24 (millions) |

| Beta: -0.13 |

| 52 Week High: $19.80 |

| 52 Week Low: $9.00 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

36.01% |

37.20% |

| 12 Week |

52.74% |

52.56% |

| Year To Date |

59.62% |

58.85% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

CLARENDON HOUSE 2 CHURCH STREET

-

HAMILTON,D0 HM 11

BMU |

ph: 1-441-299-4912

fax: 441-298-7800 |

wf@dhtankers.com |

http://www.dhtankers.com |

|

|

| |

| • General Corporate Information |

Officers

Svein Moxnes Harfjeld - President & Chief Executive Officer

Erik A. Lind - Chairman

Laila Cecilie Halvorsen - Chief Financial Officer

Einar Michael Steimler - Director

Joseph H. Pyne - Director

|

|

Peer Information

DHT Holdings, Inc. (BHODQ)

DHT Holdings, Inc. (GNK.2)

DHT Holdings, Inc. (NPTOY)

DHT Holdings, Inc. (SCRB)

DHT Holdings, Inc. (SHWK)

DHT Holdings, Inc. (ACLNF)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TRANS-SHIP

Sector: Transportation

CUSIP: Y2065G121

SIC: 4412

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 160.61

Most Recent Split Date: 7.00 (0.08:1)

Beta: -0.13

Market Capitalization: $3,130.24 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 8.41% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $1.64 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.60 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: -0.25 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/19/2026 - $0.41 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |