| Zacks Company Profile for Daikin Industries (DKILY : OTC) |

|

|

| |

| • Company Description |

| DAIKIN INDUSTRIES, LTD. manufactures air conditioning equipment for household and commercial use. The company also operates chemical, oil hydraulics, defense system and electronics businesses. It operates primarily in Japan, Asia and Oceania, Europe, the United States, China and internationally. DAIKIN INDUSTRIES, LTD. is headquartered in Osaka, Japan.

Number of Employees: 103,544 |

|

|

| |

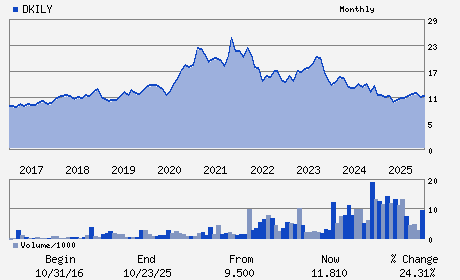

| • Price / Volume Information |

| Yesterday's Closing Price: $12.69 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 273,481 shares |

| Shares Outstanding: 2,931.13 (millions) |

| Market Capitalization: $37,196.04 (millions) |

| Beta: 0.88 |

| 52 Week High: $14.03 |

| 52 Week Low: $9.90 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

2.84% |

4.25% |

| 12 Week |

1.36% |

0.84% |

| Year To Date |

-0.47% |

-0.99% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Osaka Umeda Twin Towers South 1-13-1 Umeda Kita-ku

-

Osaka,M0 530-0001

JPN |

ph: 816-6373-4312

fax: - |

None |

http://www.daikin.com |

|

|

| |

| • General Corporate Information |

Officers

Masanori Togawa - Chief Executive Officer and Chairman

Naofumi Takenaka - President and Chief Operating Officer

Shingo Torii - Director

Akiji Makino - Director

Tatsuo Kawada - Director

|

|

Peer Information

Daikin Industries (REFR)

Daikin Industries (BELFA)

Daikin Industries (DIPC)

Daikin Industries (V.SSC)

Daikin Industries (BNSOF)

Daikin Industries (CUB.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC PRODS-MISC

Sector: Computer and Technology

CUSIP: 23381B106

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 2,931.13

Most Recent Split Date: 3.00 (20.00:1)

Beta: 0.88

Market Capitalization: $37,196.04 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.13% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.13 |

Indicated Annual Dividend: $0.14 |

| Current Fiscal Year EPS Consensus Estimate: $0.57 |

Payout Ratio: 0.23 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.03 |

| Estmated Long-Term EPS Growth Rate: 8.43% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |