| Zacks Company Profile for Dollar Tree, Inc. (DLTR : NSDQ) |

|

|

| |

| • Company Description |

| Dollar Tree Inc. is an operator of discount variety stores offering merchandise and other assortments. Its stores successfully operate in major metropolitan areas, mid-sized cities and small towns. The company offers a wide range of quality everyday general merchandise in many categories, including housewares, seasonal goods, candy and food, toys, health and beauty care, gifts, party goods, stationery, books, personal accessories, and other consumer items. Its stores are supported by a nationwide logistics network and distribution centers. Dollar Tree also owns an e-commerce platform (DollarTree.com) which sells its merchandise in bulk to individuals and small businesses as well as organizations. Through its online platform, the company advertises its in-store events and showcases its special and seasonal promotions for featured products.

Number of Employees: 214,710 |

|

|

| |

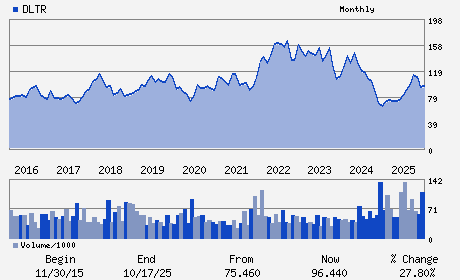

| • Price / Volume Information |

| Yesterday's Closing Price: $126.48 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,716,705 shares |

| Shares Outstanding: 198.85 (millions) |

| Market Capitalization: $25,150.95 (millions) |

| Beta: 0.73 |

| 52 Week High: $142.40 |

| 52 Week Low: $61.87 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.56% |

8.50% |

| 12 Week |

3.30% |

3.17% |

| Year To Date |

2.82% |

2.32% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Michael C. Creedon Jr. - Chief Executive Officer and Director

Edward J. Kelly, III - Chairman of the Board

Paul C. Hilal - Vice Chairman

Jeffrey A. Davis - Chief Financial Officer

Aditya Maheshwari - Senior Vice President

|

|

Peer Information

Dollar Tree, Inc. (TGT)

Dollar Tree, Inc. (BURL)

Dollar Tree, Inc. (ALCSQ)

Dollar Tree, Inc. (CLDRQ)

Dollar Tree, Inc. (BLEEQ)

Dollar Tree, Inc. (FDO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-DISCOUNT

Sector: Retail/Wholesale

CUSIP: 256746108

SIC: 5331

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/16/26

|

|

Share - Related Items

Shares Outstanding: 198.85

Most Recent Split Date: 6.00 (2.00:1)

Beta: 0.73

Market Capitalization: $25,150.95 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.58 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $6.68 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 11.76% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/16/26 |

|

|

|

| |