| Zacks Company Profile for Dorchester Minerals, L.P. (DMLP : NSDQ) |

|

|

| |

| • Company Description |

| Dorchester Minerals, L.P. engages in the acquisition, ownership, and administration of producing and nonproducing natural gas and crude oil royalty, net profits, and leasehold interests in the United States. The Company owns two categories of properties: the Net Profits Interests and the Royalty Properties, the former representing net profits overriding royalty interests in various properties owned by the operating partnership and the latter comprising of producing and nonproducing mineral, royalty, overriding royalty, net profits, and leasehold interests. The company is based in Dallas, Texas.

Number of Employees: 26 |

|

|

| |

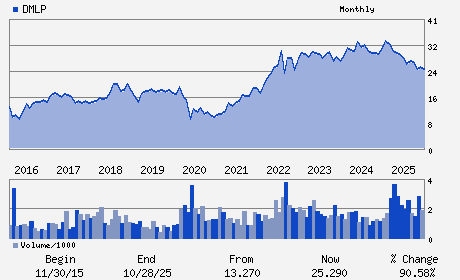

| • Price / Volume Information |

| Yesterday's Closing Price: $25.99 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 155,361 shares |

| Shares Outstanding: 48.26 (millions) |

| Market Capitalization: $1,254.16 (millions) |

| Beta: 0.62 |

| 52 Week High: $31.14 |

| 52 Week Low: $20.85 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

2.28% |

3.18% |

| 12 Week |

13.05% |

12.91% |

| Year To Date |

16.23% |

15.67% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

3838 OAK LAWN AVENUE SUITE 300

-

DALLAS,TX 75219

USA |

ph: 214-559-0300

fax: 302-655-5049 |

None |

http://www.dmlp.net |

|

|

| |

| • General Corporate Information |

Officers

Bradley Ehrman - Chief Executive Officer

Robert C. Vaughn - Interim Chairman and Manager

Lesley R. Carver - Manager

Sarah N. Wariner - Manager

Martha Ann Peak Rochelle - Manager

|

|

Peer Information

Dorchester Minerals, L.P. (DOMR)

Dorchester Minerals, L.P. (FRHLF)

Dorchester Minerals, L.P. (CRT)

Dorchester Minerals, L.P. (MOSH)

Dorchester Minerals, L.P. (LRTR)

Dorchester Minerals, L.P. (TRRU)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: OIL-US RYLTY TR

Sector: Oils/Energy

CUSIP: 25820R105

SIC: 1311

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 48.26

Most Recent Split Date: (:1)

Beta: 0.62

Market Capitalization: $1,254.16 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 11.63% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $3.02 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 2.38 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 1.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/02/2026 - $0.76 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |