| Zacks Company Profile for Denali Therapeutics Inc. (DNLI : NSDQ) |

|

|

| |

| • Company Description |

| Denali Therapeutics, a biopharmaceutical company, is developing a wide and innovative portfolio of targeted therapeutic candidates, which are engineered to cross the blood-brain barrier for neurodegenerative diseases. It has 5 clinical-stage programs, a leucine-rich repeat kinase 2 inhibitor program partnered with Biogen to address Parkinson's disease, an eukaryotic translation initiation factor 2B activator program to address diseases such as amyotrophic lateral sclerosis and frontotemporal dementia (FTD), the ETV:IDS program, which utilizes the company's enzyme transport vehicle technology, and is designed to restore iduronate 2-sulfatase and reduce glycosaminoglycans, in patients with mucopolysaccharidosis II, and two separate receptor interacting serine/threonine protein kinase 1 inhibitor programs, both partnered with Sanofi. It also has a collaboration and option agreement with Takeda Pharmaceutical Co. Ltd. Takeda has exercised its option to jointly develop and commercialize DNL593 with the company.

Number of Employees: 503 |

|

|

| |

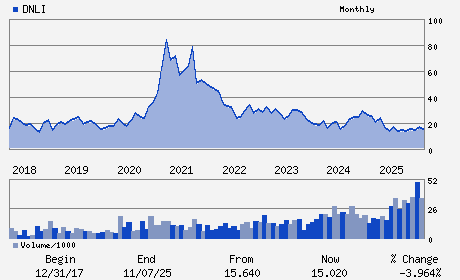

| • Price / Volume Information |

| Yesterday's Closing Price: $21.18 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,570,840 shares |

| Shares Outstanding: 158.59 (millions) |

| Market Capitalization: $3,358.97 (millions) |

| Beta: 1.02 |

| 52 Week High: $23.77 |

| 52 Week Low: $10.57 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-2.58% |

-1.72% |

| 12 Week |

6.11% |

5.98% |

| Year To Date |

28.29% |

27.66% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Ryan J. Watts - President; Chief Executive Officer and Director

Julian C. Baker - Chairperson

Alexander O. Schuth - Chief Operating and Financial Officer

Jennifer Cook - Director

Jay Flatley - Director

|

|

Peer Information

- (-)

- (-)

- (-)

- (-)

- (-)

- (-)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: 24823R105

SIC: 2836

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 158.59

Most Recent Split Date: (:1)

Beta: 1.02

Market Capitalization: $3,358.97 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.75 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-3.05 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 13.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |