| Zacks Company Profile for Dorman Products, Inc. (DORM : NSDQ) |

|

|

| |

| • Company Description |

| Dorman Products, Inc. is a leading supplier of Dealer `Exclusive` replacement parts to the Automotive, Medium and Heavy Duty Aftermarkets. Dorman products are marketed under the Dorman, OE Solutions, HELP!, AutoGrade, First Stop, Conduct-Tite, TECHoice, Dorman Hybrid Drive Batteries and Dorman HD Solutions brand names.

Number of Employees: 3,787 |

|

|

| |

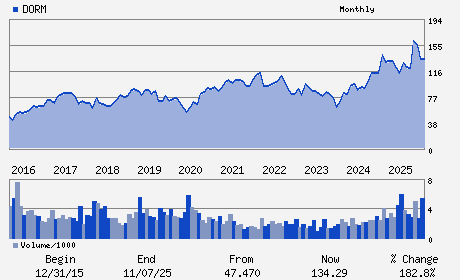

| • Price / Volume Information |

| Yesterday's Closing Price: $117.86 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 211,640 shares |

| Shares Outstanding: 30.56 (millions) |

| Market Capitalization: $3,602.11 (millions) |

| Beta: 0.92 |

| 52 Week High: $166.89 |

| 52 Week Low: $106.95 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-5.10% |

-4.27% |

| 12 Week |

-6.93% |

-7.04% |

| Year To Date |

-4.33% |

-4.79% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Kevin M. Olsen - President and Chief Executive Officer

Steven L. Berman - Non-Executive Chairman

David M. Hession - Senior Vice President; Chief Financial Officer and

Joseph P. Braun - Senior Vice President; General Counsel and Secreta

Lisa M. Bachmann - Director

|

|

Peer Information

Dorman Products, Inc. (T.BYD)

Dorman Products, Inc. (ELEEF)

Dorman Products, Inc. (MZTAQ)

Dorman Products, Inc. (EDEL)

Dorman Products, Inc. (AIRW.)

Dorman Products, Inc. (CRV)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AUTO/TRUCK-REPL

Sector: Auto/Tires/Trucks

CUSIP: 258278100

SIC: 3714

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/04/26

|

|

Share - Related Items

Shares Outstanding: 30.56

Most Recent Split Date: 6.00 (2.00:1)

Beta: 0.92

Market Capitalization: $3,602.11 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.15 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $8.30 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/04/26 |

|

|

|

| |