| Zacks Company Profile for Darden Restaurants, Inc. (DRI : NYSE) |

|

|

| |

| • Company Description |

| Darden Restaurants is one of the largest casual dining restaurant operators world wide. The company has operations in the U.S. and Canada with more than 1,700 restaurants. The company reports its business under 4 segments: Olive Garden, LongHorn Steakhouse, Fine Dining and Other Business. Florida-based Olive Garden is the largest full-service Italian restaurant in America. The brand features a menu, which has a variety of Italian food made with fresh ingredients. LongHorn Steakhouse is a full-service steakhouse restaurant, with locations primarily in the eastern United States. Fine Dining, includes The Capital Grille and Eddie V's while the Other Business segment comprises of Cheddar's Scratch Kitchen, Yard House, Seasons 52, Bahama Breeze, consumer packaged goods and franchise revenues. The casual dining menu features modern classics and American favorites cooked from scratch.

Number of Employees: 197,924 |

|

|

| |

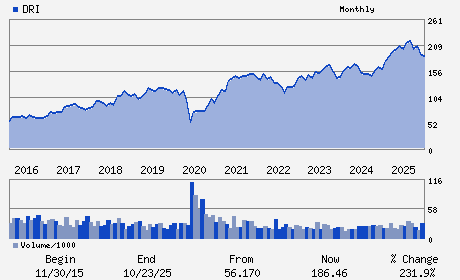

| • Price / Volume Information |

| Yesterday's Closing Price: $213.85 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,175,631 shares |

| Shares Outstanding: 115.14 (millions) |

| Market Capitalization: $24,622.53 (millions) |

| Beta: 0.61 |

| 52 Week High: $228.27 |

| 52 Week Low: $169.00 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.27% |

8.21% |

| 12 Week |

20.33% |

20.18% |

| Year To Date |

16.21% |

15.65% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1000 DARDEN CENTER DRIVE

-

ORLANDO,FL 32837

USA |

ph: 407-245-4000

fax: 407-245-4989 |

irinfo@darden.com |

http://www.darden.com |

|

|

| |

| • General Corporate Information |

Officers

Ricardo Cardenas - President; Chief Executive Officer and Director

Cynthia T. Jamison - Chairman and Director

Rajesh Vennam - Senior Vice President; Chief Financial Officer

John W. Madonna - Senior Vice President; Corporate Controller

Margaret Shan Atkins - Director

|

|

Peer Information

Darden Restaurants, Inc. (BH)

Darden Restaurants, Inc. (BUCA)

Darden Restaurants, Inc. (BUNZQ)

Darden Restaurants, Inc. (FRRG)

Darden Restaurants, Inc. (CHEF.)

Darden Restaurants, Inc. (BGMTQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-RESTRNTS

Sector: Retail/Wholesale

CUSIP: 237194105

SIC: 5812

|

|

Fiscal Year

Fiscal Year End: May

Last Reported Quarter: 11/01/25

Next Expected EPS Date: 03/19/26

|

|

Share - Related Items

Shares Outstanding: 115.14

Most Recent Split Date: 5.00 (1.50:1)

Beta: 0.61

Market Capitalization: $24,622.53 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.81% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.95 |

Indicated Annual Dividend: $6.00 |

| Current Fiscal Year EPS Consensus Estimate: $10.59 |

Payout Ratio: 0.61 |

| Number of Estimates in the Fiscal Year Consensus: 12.00 |

Change In Payout Ratio: -0.07 |

| Estmated Long-Term EPS Growth Rate: 9.87% |

Last Dividend Paid: 01/09/2026 - $1.50 |

| Next EPS Report Date: 03/19/26 |

|

|

|

| |