| Zacks Company Profile for DSV (DSDVY : OTC) |

|

|

| |

| • Company Description |

| DSV A/S provides transport and logistics services. It offers truck, ship and plane transport services as well as warehousing and logistic services. The company also provides shipment booking, pick-up, custom clearance, cargo consolidation, document and insurance services as well as warehousing, picking/packaging, distribution, supply chain management and order planning services. It operates primarily in Europe, the Middle East, Africa, North and South America, Asia, Australia and the Pacific. DSV A/S is headquartered in Hedehusene, Denmark.

Number of Employees: 73,338 |

|

|

| |

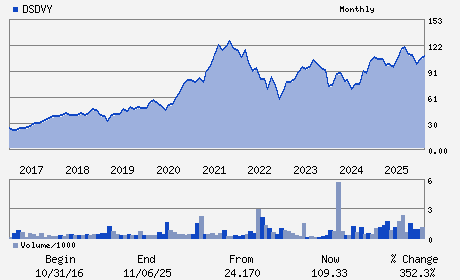

| • Price / Volume Information |

| Yesterday's Closing Price: $128.84 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 87,132 shares |

| Shares Outstanding: 480.89 (millions) |

| Market Capitalization: $61,957.75 (millions) |

| Beta: 1.30 |

| 52 Week High: $151.98 |

| 52 Week Low: $77.78 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-8.71% |

-7.46% |

| 12 Week |

6.59% |

6.04% |

| Year To Date |

1.98% |

1.44% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

HOVEDGADEN 630

-

HEDEHUSENE,G7 2640

DNK |

ph: 212-336-2301

fax: - |

None |

http://www.dsv.com |

|

|

| |

| • General Corporate Information |

Officers

Jens Hesselberg Lund - Chief Executive Officer

Thomas Plenborg - Chairman

Jorgen Moller - Deputy Chairman

Brian Ejsing - Chief Operating Officer

Michael Ebbe - Chief Financial Officer

|

|

Peer Information

DSV (HKAEY)

DSV (UHAL)

DSV (LYNG)

DSV (MATX)

DSV (GLC)

DSV (FAVS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TRANS-SERVICES

Sector: Transportation

CUSIP: 26251A108

SIC: 4700

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 480.89

Most Recent Split Date: (:1)

Beta: 1.30

Market Capitalization: $61,957.75 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.23% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.00 |

Indicated Annual Dividend: $0.30 |

| Current Fiscal Year EPS Consensus Estimate: $5.28 |

Payout Ratio: 0.08 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.01 |

| Estmated Long-Term EPS Growth Rate: 25.49% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |