| Zacks Company Profile for DXC Technology Company. (DXC : NYSE) |

|

|

| |

| • Company Description |

| DXC Technology Company offers a broad array of professional services to clients in the global, commercial and government markets. It specializes in information technology (IT) systems consulting - designing, developing, implementing, and integrating information systems. The company also provides business process outsourcing (BPO) and manages key functions for clients, such as procurement and supply chain, call centers and customer relationship management, credit services, claims processing and logistics. Apart from this, Computer Sciences' IT and management consulting services advise clients on acquisitions, IT security, strategy and business process re-engineering. The company also licenses sophisticated software systems for the financial services markets and provides a broad array of e-business solutions that cater to the needs of large commercial and government clients.

Number of Employees: 120,000 |

|

|

| |

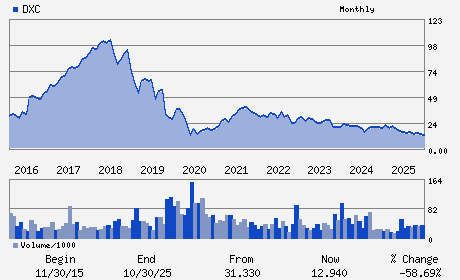

| • Price / Volume Information |

| Yesterday's Closing Price: $12.59 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,951,856 shares |

| Shares Outstanding: 169.76 (millions) |

| Market Capitalization: $2,137.28 (millions) |

| Beta: 1.10 |

| 52 Week High: $18.90 |

| 52 Week Low: $11.61 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-12.75% |

-11.99% |

| 12 Week |

-10.84% |

-10.95% |

| Year To Date |

-14.06% |

-14.48% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

20408 BASHAN DRIVE SUITE 231

-

ASHBURN,VA 20147

USA |

ph: 703-972-7000

fax: 310-640-2648 |

investor.relations@dxc.com |

https://dxc.com |

|

|

| |

| • General Corporate Information |

Officers

Raul Fernandez - Chief Executive Officer and President

David L. Herzog - Chairman

Rob Del Bene - Executive Vice President and Chief Financial Offic

Christopher A. Voci - Senior Vice President and Corporate Controller

David A. Barnes - Director

|

|

Peer Information

DXC Technology Company. (UIS)

DXC Technology Company. (CTSH)

DXC Technology Company. (ASGN)

DXC Technology Company. (GTTNQ)

DXC Technology Company. (DXC)

DXC Technology Company. (DOX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: IT Services

Sector: Computer and Technology

CUSIP: 23355L106

SIC: 7374

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/13/26

|

|

Share - Related Items

Shares Outstanding: 169.76

Most Recent Split Date: 3.00 (2.00:1)

Beta: 1.10

Market Capitalization: $2,137.28 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.74 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $3.20 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/13/26 |

|

|

|

| |