| Zacks Company Profile for DXP Enterprises, Inc. (DXPE : NSDQ) |

|

|

| |

| • Company Description |

| DXP Enterprises, Inc. is a leading products and service distributor that adds value and total cost savings solutions to industrial customers throughout the United States, Canada, Mexico and Dubai. DXP provides innovative pumping solutions, supply chain services and maintenance, repair, operating and production (`MROP`) services that emphasize and utilize DXP's vast product knowledge and technical expertise in rotating equipment, bearings, power transmission, metal working, industrial supplies and safety products and services. DXP's breadth of MROP products and service solutions allows DXP to be flexible and customer-driven, creating competitive advantages for our customers. DXP's business segments include Service Centers, Innovative Pumping Solutions and Supply Chain Services.

Number of Employees: 1,843 |

|

|

| |

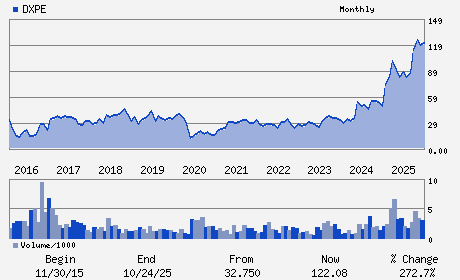

| • Price / Volume Information |

| Yesterday's Closing Price: $115.49 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 147,716 shares |

| Shares Outstanding: 15.68 (millions) |

| Market Capitalization: $1,810.80 (millions) |

| Beta: 1.01 |

| 52 Week High: $130.97 |

| 52 Week Low: $67.68 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

23.62% |

21.05% |

| 12 Week |

-3.01% |

-6.11% |

| Year To Date |

39.78% |

18.99% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

5301 HOLLISTER

-

HOUSTON,TX 77040

USA |

ph: 713-996-4700

fax: 713-996-4701 |

ir@dxpe.com |

http://www.dxpe.com |

|

|

| |

| • General Corporate Information |

Officers

David R. Little - Chairman; President; Chief Executive Officer and D

Kent Yee - Senior Vice President; Chief Financial Officer; Se

David Molero Santos - Vice President and Chief Accounting Officer

Timothy P. Halter - Director

David Patton - Director

|

|

Peer Information

DXP Enterprises, Inc. (B.)

DXP Enterprises, Inc. (DXPE)

DXP Enterprises, Inc. (AIT)

DXP Enterprises, Inc. (GDI.)

DXP Enterprises, Inc. (CTITQ)

DXP Enterprises, Inc. (EBCOY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH-GENL INDL

Sector: Industrial Products

CUSIP: 233377407

SIC: 5084

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/05/26

|

|

Share - Related Items

Shares Outstanding: 15.68

Most Recent Split Date: 10.00 (2.00:1)

Beta: 1.01

Market Capitalization: $1,810.80 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.91 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $5.03 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/05/26 |

|

|

|

| |