| Zacks Company Profile for ECARX Holdings, Inc. (ECX : NSDQ) |

|

|

| |

| • Company Description |

| ECARX Holdings Inc. is a mobility tech company. Its current core products include infotainment head units, digital cockpits, vehicle chip-set solutions, a core operating system and integrated software stack. ECARX Holdings Inc., formerly known as COVA Acquisition Corp., is based in LONDON.

Number of Employees: 1,918 |

|

|

| |

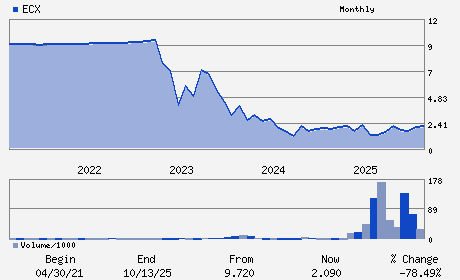

| • Price / Volume Information |

| Yesterday's Closing Price: $1.68 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,735,777 shares |

| Shares Outstanding: 370.73 (millions) |

| Market Capitalization: $622.83 (millions) |

| Beta: 0.77 |

| 52 Week High: $3.25 |

| 52 Week Low: $0.76 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-6.67% |

-5.85% |

| 12 Week |

-20.00% |

-20.10% |

| Year To Date |

-2.33% |

-2.80% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

12/F Tower 2 Park Place 88 Baise Road Xuhui District

-

Shanghai,F4 200231

CHN |

ph: 86-571-8530-6757

fax: - |

ir@ecarxgroup.com |

http://www.ecarxgroup.com |

|

|

| |

| • General Corporate Information |

Officers

Ziyu Shen - Chairman and Chief Executive Officer

Peter Cirino - Chief Operating Officer

Jing Phil Zhou - Chief Financial Officer

Zenggang Liu - Director

Ni Li - Director

|

|

Peer Information

ECARX Holdings, Inc. (EVOL)

ECARX Holdings, Inc. (RAMP)

ECARX Holdings, Inc. (LGTY)

ECARX Holdings, Inc. (ALOT)

ECARX Holdings, Inc. (CXT)

ECARX Holdings, Inc. (TGHI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Technology Services

Sector: Business Services

CUSIP: G29201103

SIC: 7373

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 370.73

Most Recent Split Date: (:1)

Beta: 0.77

Market Capitalization: $622.83 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.04 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |