| Zacks Company Profile for The Estee Lauder Companies Inc. (EL : NYSE) |

|

|

| |

| • Company Description |

| The Estee Lauder Companies Inc. is one of the world's leading manufacturers and marketers of skin care, makeup, fragrance and hair care products. The company's products are sold through department stores, mass retailers, company-owned retail stores, hair salons and travel-related establishments. The company reports operating results in terms of product categories and geographic regions. In terms of product categories, The Estee Lauder Companies' primary segments include: Skin Care division - This segment sells skin care products for men and women. Makeup division - This segment manufactures, markets and sells makeup products. Fragrances division - This segment sells fragrance products for men and women. Hair care division - This segment includes hair color and styling products, shampoos, conditioners, and finishing sprays.??Other division: This segment sells ancillary products and services. Region-wise, the company reports under America, Europe, the Middle East & Africa and Asia-Pacific.

Number of Employees: 57,000 |

|

|

| |

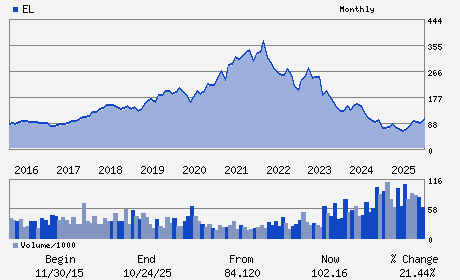

| • Price / Volume Information |

| Yesterday's Closing Price: $109.47 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 4,836,475 shares |

| Shares Outstanding: 361.73 (millions) |

| Market Capitalization: $39,598.26 (millions) |

| Beta: 1.11 |

| 52 Week High: $121.64 |

| 52 Week Low: $48.37 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-5.04% |

-4.21% |

| 12 Week |

4.13% |

4.00% |

| Year To Date |

4.54% |

4.03% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Stephane de La Faverie - Chief Executive Officer and President

William P. Lauder - Chairman

Akhil Shrivastava - Executive Vice President and Chief Financial Offic

Charlene Barshefsky - Director

Angela Wei Dong - Director

|

|

Peer Information

The Estee Lauder Companies Inc. (DYPR)

The Estee Lauder Companies Inc. (EWCZ)

The Estee Lauder Companies Inc. (HELE)

The Estee Lauder Companies Inc. (EROX)

The Estee Lauder Companies Inc. (ACV.)

The Estee Lauder Companies Inc. (G.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: COSMETICS&TLTRS

Sector: Consumer Staples

CUSIP: 518439104

SIC: 2844

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 361.73

Most Recent Split Date: 1.00 (2.00:1)

Beta: 1.11

Market Capitalization: $39,598.26 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.28% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.67 |

Indicated Annual Dividend: $1.40 |

| Current Fiscal Year EPS Consensus Estimate: $2.23 |

Payout Ratio: 0.72 |

| Number of Estimates in the Fiscal Year Consensus: 11.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 40.10% |

Last Dividend Paid: 02/27/2026 - $0.35 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |