| Zacks Company Profile for Entegris, Inc. (ENTG : NSDQ) |

|

|

| |

| • Company Description |

| Entegris is a leading provider of materials management solutions to themicroelectronics industry including, in particular, the semiconductormanufacturing and disk manufacturing markets. The company's materials management solutions for the semiconductor industry assure the integrity of materials as they are handled, stored, processed and transported throughout the semiconductor manufacturing process. These solutions enable customers to protect their investment in work-in-process and finished devices.

Number of Employees: 7,700 |

|

|

| |

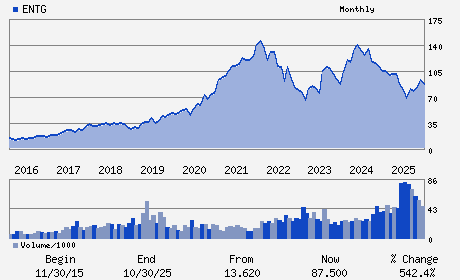

| • Price / Volume Information |

| Yesterday's Closing Price: $132.45 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,170,861 shares |

| Shares Outstanding: 152.00 (millions) |

| Market Capitalization: $20,132.40 (millions) |

| Beta: 1.30 |

| 52 Week High: $142.50 |

| 52 Week Low: $60.75 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

12.18% |

13.16% |

| 12 Week |

48.57% |

48.39% |

| Year To Date |

57.21% |

56.45% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

David Reeder - President; Chief Executive Officer

Bertrand Loy - Executive Chair

Linda LaGorga - Senior Vice President; Chief Financial Officer

Michael D. Sauer - Vice President; Controller & Chief Accounting Offi

Rodney Clark - Director

|

|

Peer Information

Entegris, Inc. (CPCL.)

Entegris, Inc. (HIFN)

Entegris, Inc. (SEM.1)

Entegris, Inc. (DION)

Entegris, Inc. (AMKR)

Entegris, Inc. (CNXT.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC COMP-SEMIC

Sector: Computer and Technology

CUSIP: 29362U104

SIC: 3089

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 152.00

Most Recent Split Date: (:1)

Beta: 1.30

Market Capitalization: $20,132.40 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.30% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.75 |

Indicated Annual Dividend: $0.40 |

| Current Fiscal Year EPS Consensus Estimate: $3.40 |

Payout Ratio: 0.15 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.02 |

| Estmated Long-Term EPS Growth Rate: 15.65% |

Last Dividend Paid: 01/28/2026 - $0.10 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |