| Zacks Company Profile for EOG Resources, Inc. (EOG : NYSE) |

|

|

| |

| • Company Description |

| EOG Resources Inc. is primarily involved in exploring and producing oil and natural gas. The leading upstream energy player's operations are spread across the United States, China and Trinidad. In the United States, the company operates in prolific resources with huge reserves of oil and natural gas. The significant reserve bases are likely to boost the company's oil and natural gas production in the coming years. EOG Resources added that it employs technologies like horizontal drilling and advanced completion techniques to maximize production from the wells. EOG Resources' operations in Trinidad include upstream activities in fields located at South East Coast Consortium. From these resources, the company produces natural gas under supply contracts.

Number of Employees: 3,400 |

|

|

| |

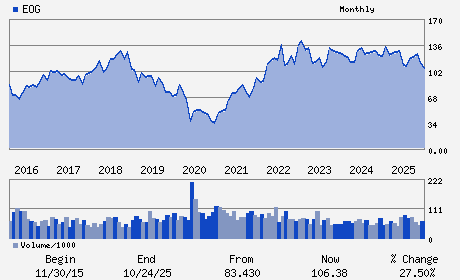

| • Price / Volume Information |

| Yesterday's Closing Price: $128.01 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 5,408,947 shares |

| Shares Outstanding: 536.49 (millions) |

| Market Capitalization: $68,676.27 (millions) |

| Beta: 0.44 |

| 52 Week High: $131.32 |

| 52 Week Low: $101.59 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

15.92% |

17.64% |

| 12 Week |

17.02% |

17.43% |

| Year To Date |

21.90% |

22.42% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Ezra Y. Yacob - Chairman and Chief Executive Officer

Ann D. Janssen - Executive Vice President and Chief Financial Offic

Laura B. Distefano - Vice President

John D. Chandler - Director

Janet F. Clark - Director

|

|

Peer Information

EOG Resources, Inc. (AEGG)

EOG Resources, Inc. (CHAR)

EOG Resources, Inc. (CECX.)

EOG Resources, Inc. (DLOV)

EOG Resources, Inc. (WACC)

EOG Resources, Inc. (DVN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: OIL-US EXP&PROD

Sector: Oils/Energy

CUSIP: 26875P101

SIC: 1311

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 536.49

Most Recent Split Date: 4.00 (2.00:1)

Beta: 0.44

Market Capitalization: $68,676.27 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.19% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.42 |

Indicated Annual Dividend: $4.08 |

| Current Fiscal Year EPS Consensus Estimate: $9.30 |

Payout Ratio: 0.40 |

| Number of Estimates in the Fiscal Year Consensus: 12.00 |

Change In Payout Ratio: 0.09 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 01/16/2026 - $1.02 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |