| Zacks Company Profile for Enerpac Tool Group Corp. (EPAC : NYSE) |

|

|

| |

| • Company Description |

| Enerpac Tool Group Corp. is involved in the designing, manufacturing and distribution of various industrial tools, including high pressure hydraulic tools and controlled force products. It also provides a wide array of services. It serves a vast client base in more than 100 countries. It has presence in the U.S., Europe, Asia, the Middle East and many other geographical locations. It reports results under two heads: Industrial Tools & Services and Other. Industrial Tools & Services segment manufactures and provides heavy lifting technology solutions, branded tools, hydraulic torque wrenches, connectors for oil & gas, manpower? and energy maintenance services, and rental capabilities of some products. Prime end-markets served include production automation, energy, industrial and mining. Highly recognized product brand includes Hydratight, Simplex, Enerpac and Larzep. Other segment includes the results of businesses of Cortland.

Number of Employees: 2,100 |

|

|

| |

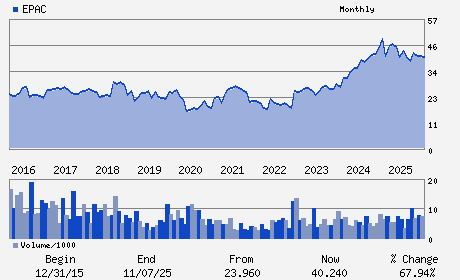

| • Price / Volume Information |

| Yesterday's Closing Price: $40.80 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 301,826 shares |

| Shares Outstanding: 52.78 (millions) |

| Market Capitalization: $2,153.27 (millions) |

| Beta: 0.96 |

| 52 Week High: $47.27 |

| 52 Week Low: $35.01 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.09% |

1.97% |

| 12 Week |

9.74% |

9.60% |

| Year To Date |

6.69% |

6.18% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Paul E. Sternlieb - President and Chief Executive Officer; Director

E. James Ferland - Chairman of the Board of Directors

Darren M. Kozik - Executive Vice President and Chief Financial Offic

Alfredo Altavilla - Director

Judy Altmaier - Director

|

|

Peer Information

Enerpac Tool Group Corp. (DVLGQ)

Enerpac Tool Group Corp. (CNM)

Enerpac Tool Group Corp. (FLOW.)

Enerpac Tool Group Corp. (AMDLY)

Enerpac Tool Group Corp. (HURC)

Enerpac Tool Group Corp. (LECO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH TLS&RL PRD

Sector: Industrial Products

CUSIP: 292765104

SIC: 3590

|

|

Fiscal Year

Fiscal Year End: August

Last Reported Quarter: 11/01/25

Next Expected EPS Date: 03/23/26

|

|

Share - Related Items

Shares Outstanding: 52.78

Most Recent Split Date: 11.00 (2.00:1)

Beta: 0.96

Market Capitalization: $2,153.27 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.10% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.39 |

Indicated Annual Dividend: $0.04 |

| Current Fiscal Year EPS Consensus Estimate: $1.92 |

Payout Ratio: 0.02 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: -0.03 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/23/26 |

|

|

|

| |