| Zacks Company Profile for Enterprise Products Partners L.P. (EPD : NYSE) |

|

|

| |

| • Company Description |

| Enterprise Products Partners is the leading midstream energy players in North America. With its wide base of midstream infrastructure assets, the partnership provides services to producers and consumers of commodities that are natural gas, natural gas liquids, oil and refined petrochemical products. Enterprise network of pipelines carry natural gas, NGL, crude oil and refined products. Enterprise operates in 4 segments: NGL Pipelines & Services, Crude Oil Pipelines & Services, Natural Gas Pipelines & Services and Petrochemical & Refined Products Services. NGL Pipelines & Services incorporates natural gas processing plants and NGL pipelines. It also owns NGL fractionators and LPG and ethane export terminals. Crude Oil Pipelines & Services are crude oil pipelines, several crude oil storage and marine terminals. Natural Gas Pipelines & Services includes natural gas pipeline systems as well as related marketing activities. Petrochemical & Refined Products Services incorporates propylene production facilities.

Number of Employees: 7,800 |

|

|

| |

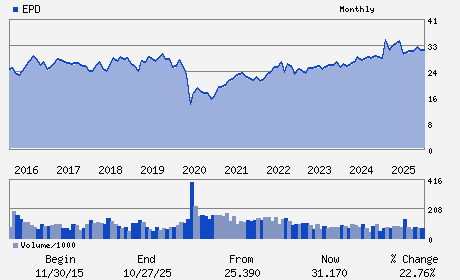

| • Price / Volume Information |

| Yesterday's Closing Price: $36.14 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 5,314,142 shares |

| Shares Outstanding: 2,163.32 (millions) |

| Market Capitalization: $78,182.42 (millions) |

| Beta: 0.58 |

| 52 Week High: $37.31 |

| 52 Week Low: $27.77 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

8.89% |

9.84% |

| 12 Week |

10.82% |

10.69% |

| Year To Date |

12.73% |

12.18% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

A. James Teague - Co-Chief Executive Officer and Director

Randa Duncan Williams - Chairman of the Board and Director

R. Daniel Boss - Executive Vice President and Chief Financial Offic

Harry P. Weitzel - Executive Vice President; General Counsel;Secretar

Carin M. Barth - Director

|

|

Peer Information

Enterprise Products Partners L.P. (KMP)

Enterprise Products Partners L.P. (OMP)

Enterprise Products Partners L.P. (WMZ)

Enterprise Products Partners L.P. (BPL)

Enterprise Products Partners L.P. (PAA)

Enterprise Products Partners L.P. (EEP)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Oil/Gas Prod Pipeline MLP

Sector: Oils/Energy

CUSIP: 293792107

SIC: 4922

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 2,163.32

Most Recent Split Date: 8.00 (2.00:1)

Beta: 0.58

Market Capitalization: $78,182.42 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 6.09% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.68 |

Indicated Annual Dividend: $2.20 |

| Current Fiscal Year EPS Consensus Estimate: $2.81 |

Payout Ratio: 0.82 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.01 |

| Estmated Long-Term EPS Growth Rate: 5.00% |

Last Dividend Paid: 01/30/2026 - $0.55 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |