| Zacks Company Profile for Equus Total Return, Inc. (EQS : NYSE) |

|

|

| |

| • Company Description |

| Equus Total Return, Inc. (the `Fund`), formerly known as Equus II Incorporated, is a business development company that provides comprehensive financing solutions for companies in industries that it believes will benefit from significant social and demographic trends. The Fund's registered investment adviser, Moore, Clayton Capital Advisors, Inc. (`the Adviser`), manages its portfolio and provides access to investment opportunities throughout the United States and internationally. The Adviser is a group company of MCC Global, an international investment advisory firm. The Fund invests in small to mid sized companies with proven, sustainable earnings and solid management and generally acts as a lead investor. It invests in companies engaged in the alternative energy, real estate, healthcare, education, e-learning, leisure and entertainment, and foreign investment sector in the United States, China, India, and Europe. The Company is based in Huston, Texas.

Number of Employees: |

|

|

| |

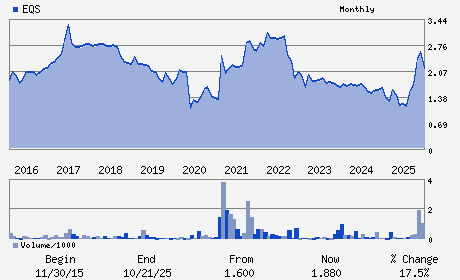

| • Price / Volume Information |

| Yesterday's Closing Price: $1.43 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,459 shares |

| Shares Outstanding: 13.97 (millions) |

| Market Capitalization: $19.97 (millions) |

| Beta: 0.58 |

| 52 Week High: $2.49 |

| 52 Week Low: $0.74 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

4.14% |

5.57% |

| 12 Week |

-17.67% |

-18.09% |

| Year To Date |

1.07% |

0.54% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

700 LOUISIANA STREET 41ST FLOOR

-

HOUSTON,TX 77002

USA |

ph: 713-529-0900

fax: 212-671-1534 |

info@equuscap.com |

http://www.equuscap.com |

|

|

| |

| • General Corporate Information |

Officers

John A. Hardy - Chief Executive Officer

L'Sheryl D. Hudson - Senior Vice President and Chief Financial Officer

Kenneth I. Denos - Secretary and Chief Compliance Officer

Fraser Atkinson - Director

Henry W. Hankinson - Director

|

|

Peer Information

Equus Total Return, Inc. (ASA)

Equus Total Return, Inc. (DNP)

Equus Total Return, Inc. (TSI)

Equus Total Return, Inc. (HIS)

Equus Total Return, Inc. (CXE)

Equus Total Return, Inc. (CXH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FIN-INVEST FUND

Sector: Finance

CUSIP: 294766100

SIC: 6726

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding: 13.97

Most Recent Split Date: 3.00 (1.04:1)

Beta: 0.58

Market Capitalization: $19.97 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: - |

|

|

|

| |