| Zacks Company Profile for EssilorLuxottica Unsponsored ADR (ESLOY : OTC) |

|

|

| |

| • Company Description |

| EssilorLuxottica Soci?t? is involved in the design, manufacture and distribution of ophthalmic lenses, frames and sunglasses. The company's brand portfolio consists of Ray-Ban, Oakley, Varilux(R), Transitions(R), Sunglass Hut and LensCrafters. EssilorLuxottica Soci?t?, formerly known as Essilor International Soci?t? Anonyme, is based in Paris, France.

Number of Employees: 196,754 |

|

|

| |

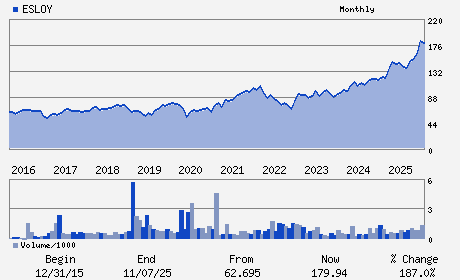

| • Price / Volume Information |

| Yesterday's Closing Price: $133.00 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 142,920 shares |

| Shares Outstanding: 926.58 (millions) |

| Market Capitalization: $123,235.04 (millions) |

| Beta: 1.02 |

| 52 Week High: $186.81 |

| 52 Week Low: $126.47 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-12.94% |

-12.18% |

| 12 Week |

-24.50% |

-24.60% |

| Year To Date |

-16.05% |

-16.45% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Francesco Milleri - Chief Executive Officer and Chairman

Paul du Saillant - Deputy Chief Executive Officer

Jean-Luc Biamonti - Chairman

Stefano Grassi - Director

Swati A. Piramal - Director

|

|

Peer Information

EssilorLuxottica Unsponsored ADR (BJCT)

EssilorLuxottica Unsponsored ADR (CADMQ)

EssilorLuxottica Unsponsored ADR (APNO)

EssilorLuxottica Unsponsored ADR (UPDC)

EssilorLuxottica Unsponsored ADR (IMTIQ)

EssilorLuxottica Unsponsored ADR (CYGN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED PRODUCTS

Sector: Medical

CUSIP: 297284200

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: 05/13/26

|

|

Share - Related Items

Shares Outstanding: 926.58

Most Recent Split Date: (:1)

Beta: 1.02

Market Capitalization: $123,235.04 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.22% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $1.62 |

| Current Fiscal Year EPS Consensus Estimate: $4.45 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 9.42% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/13/26 |

|

|

|

| |