| Zacks Company Profile for Evogene Ltd. (EVGN : NSDQ) |

|

|

| |

| • Company Description |

| Evogene is a leading computational biology company targeting to revolutionize product development for life-science based industries, including human health, agriculture, and industrial applications. Incorporating a deep understanding of biology and leveraging Big Data and Artificial Intelligence, Evogene established its unique technology, the Computational Predictive Biology (CPB) platform. The CPB platform is designed to computationally discover and develop life-science products based on microbes, small molecules, and genetic elements as the core components for such products. Evogene holds a number of subsidiaries utilizing the CPB platform to develop human microbiome-based therapeutics, medical cannabis, ag-biologicals, ag-chemicals, seed traits, and ag-solutions for castor oil production.

Number of Employees: 117 |

|

|

| |

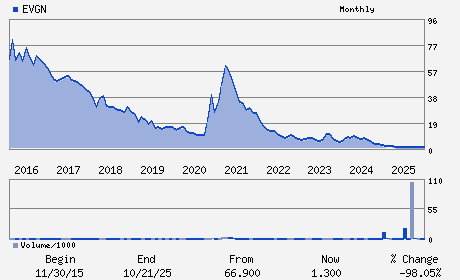

| • Price / Volume Information |

| Yesterday's Closing Price: $0.88 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,239,374 shares |

| Shares Outstanding: 5.37 (millions) |

| Market Capitalization: $4.71 (millions) |

| Beta: 1.36 |

| 52 Week High: $2.42 |

| 52 Week Low: $0.81 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-13.09% |

-12.33% |

| 12 Week |

-20.92% |

-21.02% |

| Year To Date |

-20.20% |

-20.59% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Ofer Haviv - Chief Executive Officer and President

Nir Nimrodi - Chairperson of the Board

Yaron Eldad - Chief Financial Officer

Gabi Tarcic - Vice President

Sarit Firon - Director

|

|

Peer Information

Evogene Ltd. (CORR.)

Evogene Ltd. (RSPI)

Evogene Ltd. (CGXP)

Evogene Ltd. (BGEN)

Evogene Ltd. (GTBP)

Evogene Ltd. (RGRX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: M4119S187

SIC: 2870

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/05/26

|

|

Share - Related Items

Shares Outstanding: 5.37

Most Recent Split Date: 7.00 (0.10:1)

Beta: 1.36

Market Capitalization: $4.71 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/05/26 |

|

|

|

| |