| Zacks Company Profile for National Vision Holdings, Inc. (EYE : NSDQ) |

|

|

| |

| • Company Description |

| National Vision Holdings, Inc. is one of the leading and rapidly growing optical retailers in the U.S. It provides budget-friendly eye exams, eyeglasses and contact lenses to low-income consumers and aims at making eye care and eyewear reasonable for all Americans. The company operates through a diverse portfolio of retail stores across brands and consumer websites. The company uses third-party carriers to transport all products from the distribution centers to the destination. It operates through 2 reportable segments. Owned & host segment includes the company's owned brands, namely, America's Best and Eyeglass World along with its Vista Optical locations in Fred Meyer stores. National Vision also provides affordable eye care products and services to American military service members within the owned & host segment. Legacy segment comprises National Vision's old strategic collaboration with Walmart to run to Vision Centers in certain Walmart stores.

Number of Employees: 13,411 |

|

|

| |

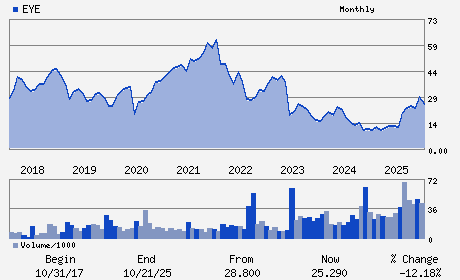

| • Price / Volume Information |

| Yesterday's Closing Price: $26.93 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,074,071 shares |

| Shares Outstanding: 79.31 (millions) |

| Market Capitalization: $2,135.81 (millions) |

| Beta: 1.38 |

| 52 Week High: $30.02 |

| 52 Week Low: $10.45 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-0.52% |

0.85% |

| 12 Week |

-4.67% |

-5.16% |

| Year To Date |

4.30% |

3.75% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

L. Reade Fahs - Chief Executive Officer and Director

D. Randolph Peeler - Chairman and Director

Alex Wilkes - President

Melissa Rasmussen - Senior Vice President and Chief Financial Officer

Jared Brandman - Senior Vice President; Chief Legal and Strategy Of

|

|

Peer Information

National Vision Holdings, Inc. (EPC)

National Vision Holdings, Inc. (HPPS)

National Vision Holdings, Inc. (ADRNY)

National Vision Holdings, Inc. (YHGJ)

National Vision Holdings, Inc. (GPSYY)

National Vision Holdings, Inc. (HENKY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CONS PD- MISC STPL

Sector: Consumer Staples

CUSIP: 63845R107

SIC: 3851

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/04/26

|

|

Share - Related Items

Shares Outstanding: 79.31

Most Recent Split Date: (:1)

Beta: 1.38

Market Capitalization: $2,135.81 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.33 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.64 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 27.56% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/04/26 |

|

|

|

| |