| Zacks Company Profile for Farmmi, Inc. (FAMI : NSDQ) |

|

|

| |

| • Company Description |

| Farmmi Inc. is an agricultural products supplier. The company processes and sells Shiitake mushrooms, Mu Er mushrooms, edible fungi and other agricultural products. In addition, the Company's ecommerce platform Farmmi Liangpin Market, provides consumers access to locally sourced agricultural products. Farmmi Inc. is based in Lishui, Zhejiang, China.

Number of Employees: 15 |

|

|

| |

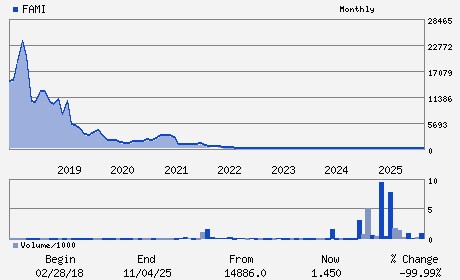

| • Price / Volume Information |

| Yesterday's Closing Price: $1.33 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 8,131 shares |

| Shares Outstanding: 5.48 (millions) |

| Market Capitalization: $7.29 (millions) |

| Beta: 1.67 |

| 52 Week High: $3.44 |

| 52 Week Low: $1.11 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-5.00% |

-4.17% |

| 12 Week |

-11.33% |

-11.44% |

| Year To Date |

4.72% |

4.22% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

FL 1 BUILDING NO. 1 888 TIANNING STREET LIANDU DISTRICT

-

LISHUI,F4 323000

CHN |

ph: 8605-78-8261-2876

fax: - |

ir@farmmi.com |

https://farmmi.com |

|

|

| |

| • General Corporate Information |

Officers

Yefang Zhang - Chief Executive Officer

Zhimin Lu - Chief Financial Officer

Chenyang Wang - Director

Qinyi Fu - Director

Hongdao Qian - Director

|

|

Peer Information

Farmmi, Inc. (DLP)

Farmmi, Inc. (CPKPY)

Farmmi, Inc. (ABTXQ)

Farmmi, Inc. (ADM)

Farmmi, Inc. (CRESY)

Farmmi, Inc. (PYYX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AGRI OPERATIONS

Sector: Consumer Staples

CUSIP: G33277149

SIC: 2033

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: -

Next Expected EPS Date: 05/12/26

|

|

Share - Related Items

Shares Outstanding: 5.48

Most Recent Split Date: 3.00 (0.08:1)

Beta: 1.67

Market Capitalization: $7.29 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/12/26 |

|

|

|

| |