| Zacks Company Profile for F5, Inc. (FFIV : NSDQ) |

|

|

| |

| • Company Description |

| F5 Networks Inc provides products and services to manage Internet traffic worldwide. Its application, delivery and networking products improve performance, availability and security of applications running on networks that use the Internet Protocol (IP). The company offers BIG-IP products to manage the IP traffic between network servers, clients and other devices. The company's FirePass systems provide SSL VPN access to remote IP network users and any applications connected to those networks from any standard web browser on any device. F5 Networks also offers TrafficShield, a web application firewall that provides an application-layer protection against generalized and targeted attacks. The company's WANJet devices helps to combine wide area network optimization and traffic shaping in a single device to accelerate file transfers, email, data replication and other applications over the IP networks.

Number of Employees: 6,578 |

|

|

| |

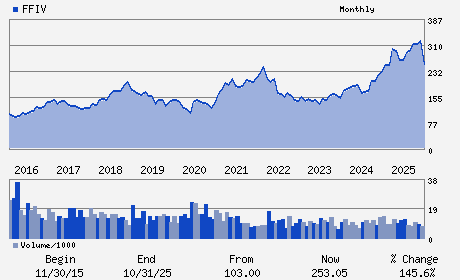

| • Price / Volume Information |

| Yesterday's Closing Price: $271.36 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 692,268 shares |

| Shares Outstanding: 56.52 (millions) |

| Market Capitalization: $15,337.07 (millions) |

| Beta: 1.01 |

| 52 Week High: $346.00 |

| 52 Week Low: $223.76 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-1.54% |

-0.68% |

| 12 Week |

9.37% |

9.23% |

| Year To Date |

6.31% |

5.79% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

801 5TH AVENUE

-

SEATTLE,WA 98104

USA |

ph: 206-272-5555

fax: 206-272-5556 |

s.dulong@f5.com |

http://www.f5.com |

|

|

| |

| • General Corporate Information |

Officers

Francois Locoh-Donou - Chief Executive Officer ; President and Director

Tom Fountain - Chief Operating Officer ;Executive Vice President

Edward Werner - Chief Financial Officer ;Executive Vice President

Alan Higginson - Director

Elizabeth L. Buse - Director

|

|

Peer Information

F5, Inc. (ADP)

F5, Inc. (CWLD)

F5, Inc. (CYBA.)

F5, Inc. (ZVLO)

F5, Inc. (AZPN)

F5, Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 315616102

SIC: 3576

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/27/26

|

|

Share - Related Items

Shares Outstanding: 56.52

Most Recent Split Date: 8.00 (2.00:1)

Beta: 1.01

Market Capitalization: $15,337.07 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.51 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $12.13 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 2.91% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/27/26 |

|

|

|

| |