| Zacks Company Profile for Leonardo S.P.A. - Unsponsored ADR (FINMY : OTC) |

|

|

| |

| • Company Description |

| Leonardo S.p.a. is an industrial and technological company, engages in the helicopters, defense electronics and security, cyber security and solutions, aircraft, aerostructures and space sectors principally in Italy, the United Kingdom, rest of Europe, the United States of America and internationally. Leonardo S.p.a. is based in Rome, Italy.

Number of Employees: 60,468 |

|

|

| |

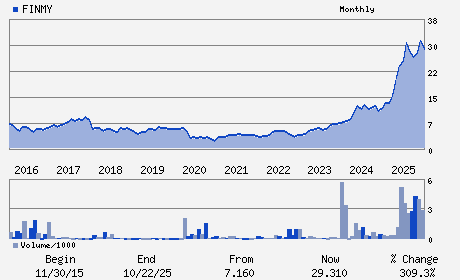

| • Price / Volume Information |

| Yesterday's Closing Price: $33.49 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 109,268 shares |

| Shares Outstanding: 1,156.30 (millions) |

| Market Capitalization: $38,724.52 (millions) |

| Beta: 0.38 |

| 52 Week High: $35.30 |

| 52 Week Low: $20.97 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.78% |

1.66% |

| 12 Week |

21.92% |

21.76% |

| Year To Date |

17.14% |

16.57% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Piazza Monte Grappa n. 4

-

Rome,L6 195

ITA |

ph: 390-632-4731

fax: 39063208621 |

ir@leonardo.com |

http://www.leonardo.com |

|

|

| |

| • General Corporate Information |

Officers

Roberto Cingolan - Chief Executive Officer

Stefano Pontecorvo - Chairman

Dominique Levy - Director

FrancescoMacri - Director

Steven Duncan Wood - Director

|

|

Peer Information

Leonardo S.P.A. - Unsponsored ADR (BA)

Leonardo S.P.A. - Unsponsored ADR (HOVR)

Leonardo S.P.A. - Unsponsored ADR (HWM)

Leonardo S.P.A. - Unsponsored ADR (LMT)

Leonardo S.P.A. - Unsponsored ADR (TOD)

Leonardo S.P.A. - Unsponsored ADR (TXT)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AEROSP/DEFENSE

Sector: Aerospace

CUSIP: 52660W101

SIC: 2520

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: 03/10/26

|

|

Share - Related Items

Shares Outstanding: 1,156.30

Most Recent Split Date: (:1)

Beta: 0.38

Market Capitalization: $38,724.52 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.49% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.16 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/10/26 |

|

|

|

| |