| Zacks Company Profile for Comfort Systems USA, Inc. (FIX : NYSE) |

|

|

| |

| • Company Description |

| Comfort Systems USA, Inc. is a national provider of comprehensive heating, ventilation and air conditioning installation, maintenance, repair and replacement services. The Company operates primarily in the commercial and industrial HVAC markets, and perform most of their services within manufacturing plants, office buildings, retail centers, apartment complexes, and healthcare, education and government facilities. Comfort Systems USA merged with the best regional experts, and now provides nationwide reach through 36 subsidiary companies that are prepared to build, service or retrofit any mechanical, HVAC or electrical system. Whether the project is Design-Build or Plan and Spec, Comfort Systems USA can help from the design phase to construction with qualified professionals, quality products and an experienced contractor team.

Number of Employees: 22,700 |

|

|

| |

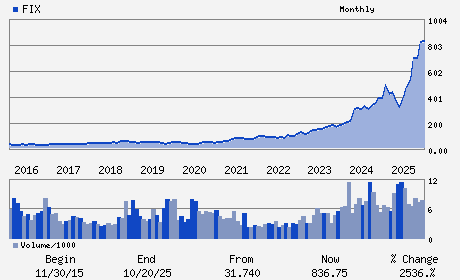

| • Price / Volume Information |

| Yesterday's Closing Price: $1,429.37 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 454,184 shares |

| Shares Outstanding: 35.17 (millions) |

| Market Capitalization: $50,278.04 (millions) |

| Beta: 1.62 |

| 52 Week High: $1,500.00 |

| 52 Week Low: $276.44 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

25.15% |

26.25% |

| 12 Week |

42.73% |

42.55% |

| Year To Date |

53.15% |

52.41% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Brian E. Lane - Chief Executive Officer and Director

Franklin Myers - Chair of the Board

William George - Executive Vice President and Chief Financial Offic

Julie S. Shaeff - Senior Vice President and Chief Accounting Officer

Darcy G. Anderson - Director

|

|

Peer Information

Comfort Systems USA, Inc. (CCOM.)

Comfort Systems USA, Inc. (MGCLY)

Comfort Systems USA, Inc. (FBIN)

Comfort Systems USA, Inc. (LII)

Comfort Systems USA, Inc. (SPXC)

Comfort Systems USA, Inc. (MTINQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG PRD-AIR/HT

Sector: Construction

CUSIP: 199908104

SIC: 1731

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/23/26

|

|

Share - Related Items

Shares Outstanding: 35.17

Most Recent Split Date: (:1)

Beta: 1.62

Market Capitalization: $50,278.04 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.17% |

| Current Fiscal Quarter EPS Consensus Estimate: $7.01 |

Indicated Annual Dividend: $2.40 |

| Current Fiscal Year EPS Consensus Estimate: $37.01 |

Payout Ratio: 0.08 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: -0.03 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/23/26 |

|

|

|

| |