| Zacks Company Profile for 1-800 FLOWERS.COM, Inc. (FLWS : NSDQ) |

|

|

| |

| • Company Description |

| 1-800-FLOWERS.COM, Inc. is a leading e-commerce provider of floral productsand gifts, in terms of number of customers and revenue. With the development of the company's online business and a strategic acquisition, they have continuously expanded their product offerings, most recently to include gourmet foods and home and garden merchandise. As a result, the company has developed relationships with customers who purchase products not only for gifting occasions but also for everyday consumption.

Number of Employees: 3,900 |

|

|

| |

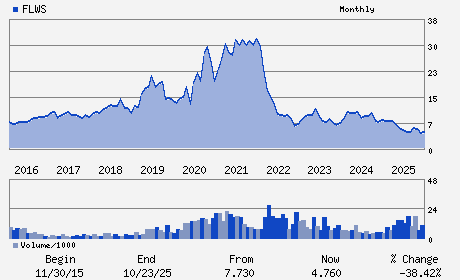

| • Price / Volume Information |

| Yesterday's Closing Price: $3.48 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 561,281 shares |

| Shares Outstanding: 64.07 (millions) |

| Market Capitalization: $222.95 (millions) |

| Beta: 1.21 |

| 52 Week High: $8.44 |

| 52 Week Low: $2.93 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-19.44% |

-18.74% |

| 12 Week |

-0.57% |

-0.69% |

| Year To Date |

-11.45% |

-11.88% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Adolfo Villagomez - Chief Executive Officer

James F. McCann - Executive Chairman

James Langrock - Chief Financial Officer

Priscilla Kasenchak - Senior Vice President

Christopher G. McCann - Director

|

|

Peer Information

1-800 FLOWERS.COM, Inc. (CTAC.)

1-800 FLOWERS.COM, Inc. (VITC)

1-800 FLOWERS.COM, Inc. (SGDE)

1-800 FLOWERS.COM, Inc. (EFTD)

1-800 FLOWERS.COM, Inc. (GDIRQ)

1-800 FLOWERS.COM, Inc. (NSIT)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-MAIL ORD

Sector: Retail/Wholesale

CUSIP: 68243Q106

SIC: 5990

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 64.07

Most Recent Split Date: (:1)

Beta: 1.21

Market Capitalization: $222.95 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.67 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-1.12 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 15.00% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |